Dear readers, we had often urged for more slumps in our previous write up in August month, and rest is history and we continue to maintain the same opinion, for more reading on our previous write up by following below weblink:

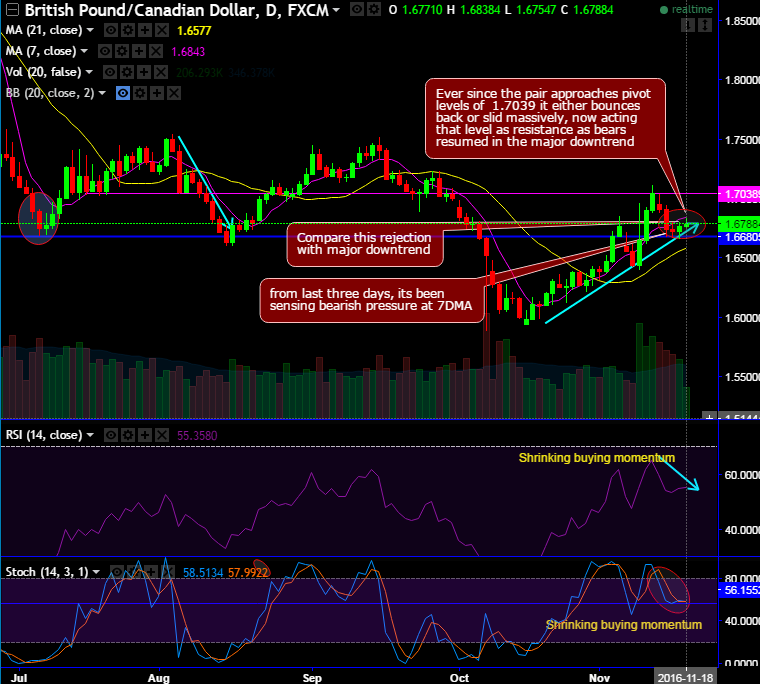

Ever since the pair approaches pivot levels of 1.7039 it either bounces back or slid massively, now acting that level as resistance as bears resumed in the major downtrend

Compare this rejection with major downtrend.

For now, although you see rallies from last three days after testing support at 1.6666 levels, it’s been sensing bearish pressure at 7DMA.

The major bear trend seems robust after breaking supports at 1.7976, upswings likely to be restrained 7EMA.

Volumes formation has been mammoth on declining trend.

MACD signals the major downtrend likely to prolong further.

On both daily and monthly RSI oscillator, we see little indecisiveness but slightly bearish biased when prices decline.

%D line crossover right from the overbought zone and its attempt of sustenance on slow stochastic has been a caution for aggressive bulls, we could foresee that there is still visible selling pressure.

Well, the current month’s rallies are just like when the formation of dragonfly doji would mean that the bears have just taken a brief halt and likely to resume the major trend at any time.

Hence, we reckon that the boundary binary option is useful for speculation of swings of this pair who believe the price of an underlying FX may undergo both bullish and bearish movement, but who are sure of barriers.

A trader can use binary options with barriers at 1.6843 and 1.6680 to capitalize on this outlook.

Some traders view this type of exotic option as being like a strangle shorting position since the trader stands to benefit on a calculated price movement up or down in both scenarios as long as underlying remains within the strikes.