Chart - Courtesy Trading View

Technical Analysis:

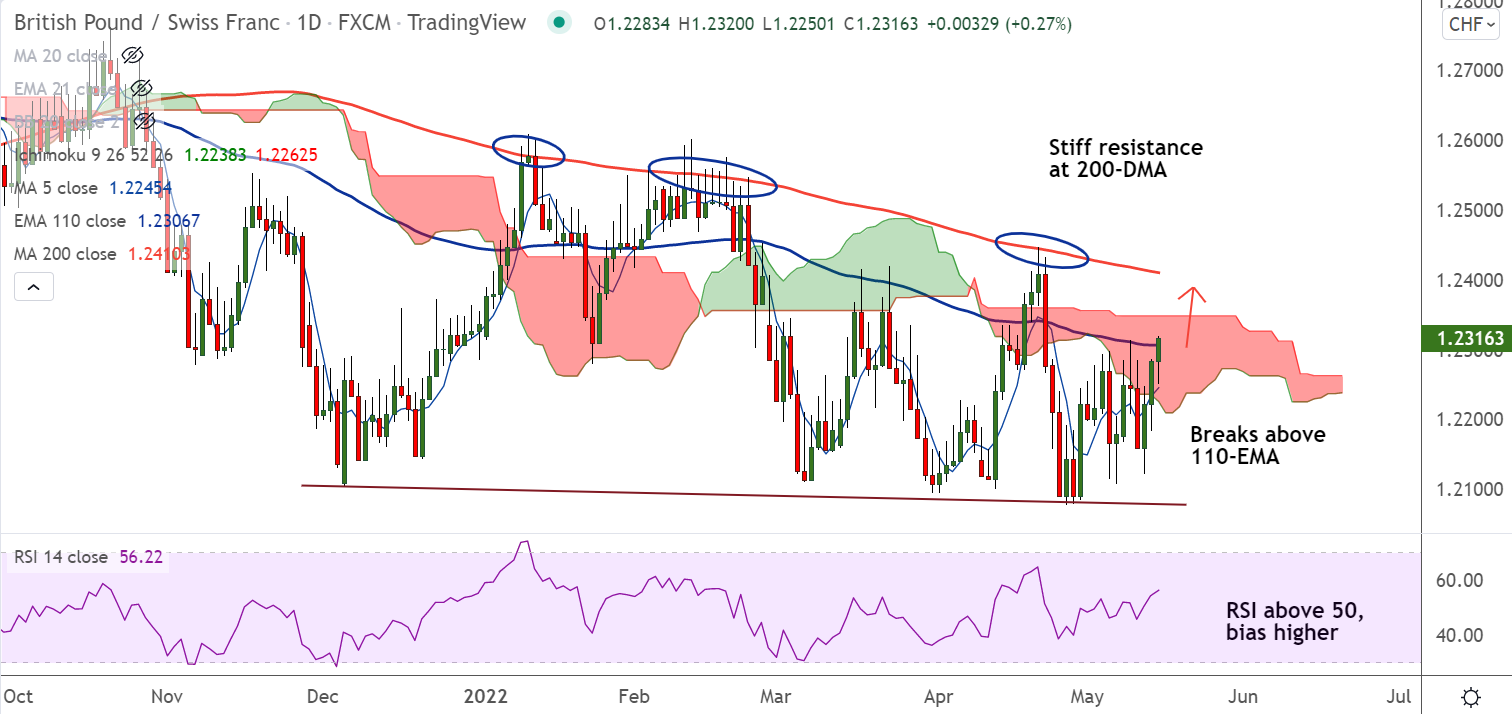

- GBP/CHF was trading 0.24% higher on the day at 1.2312 at around 11:10 GMT

- The pair is extending upside for the third straight session

- Price action has broken above 200H MA and hovers around 110-EMA

- Momentum is bullish, Stochs and RSI are sharply higher

- GMMA indicator shows minor trend has turned bullish, but major trend is neutral

Support levels - 1.2251 (55-EMA), 1.2242 (5-DMA), 1.2225 (Cloud base)

Resistance levels - 1.2306 (110-EMA), 1.2374 (55-week EMA), 1.2410 (200-DMA)

Summary: GBP/CHF pivotal at 110-EMA resistance. Watch out for decisive break above for upside continuation.