GBP/CHF chart - Trading View

GBP/CHF was trading largely unchanged at 1.2788 at around 11:20 GMT, after closing 0.61% higher in the previous session.

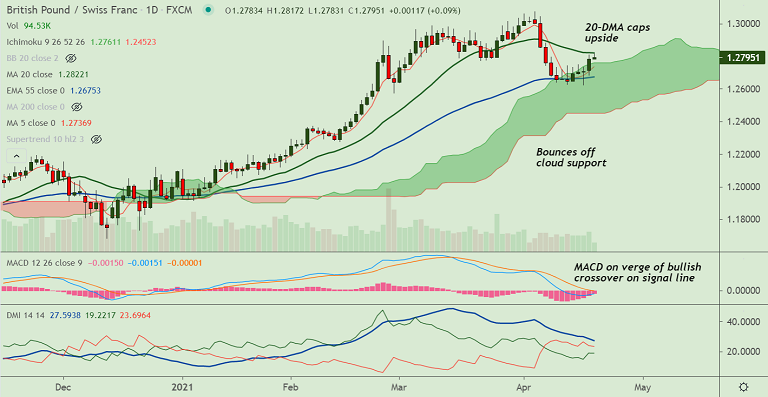

The pair has slipped lower from session highs at 1.2817, upside remains capped at 20-DMA.

Upbeat UK ILO unemployment data and optimism concerning the UK’s economic recovery keep the pound supported.

Technical bias for the pair is bullish. GMMA indicator shows major trend is bullish and minor trend is turning bullish.

Pullback on account of overbought conditions and bearish divergence has held support at daily cloud.

RSI has turned bullish again and Stochs have rolled over from oversold levels. MACD is on verge of bullish crossover on signal line.

Break above 20-DMA is set to fuel further upside. Scope for retest of 88.6% Fib at 1.3060. Retrace below cloud is negates any bullish bias.