GBP/CHF chart - Trading View

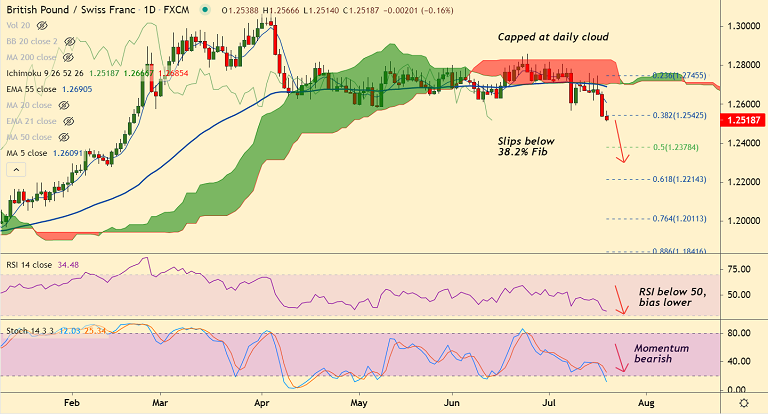

GBP/CHF extends previous session's slump, slips below 38.2% Fib, outlook bearish.

Pound undermined by dovish comments yesterday from BoE officials and ongoing virus concerns.

BoE MPC members expressed concern that tightening policy prematurely will result in a weaker economic recovery.

Further, the ongoing spike in Delta coronavirus strain overshadowed the UK's decision to lift COVID-19 restrictions on July 19.

In the latest development, the UK Health Minister Sajid Javid tested positive for COVID-19.

Risk-off across markets is seeing a flight to safe-haven assets like the Swiss Franc, dragging the pair lower.

Technical indicators also support weakness in the pair. Price action has slipped below 200-week MA.

MACD and ADX support weakness. Bearish momentum and rising volatility to drag prices lower. Scope for test of 200-DMA at 1.2417.