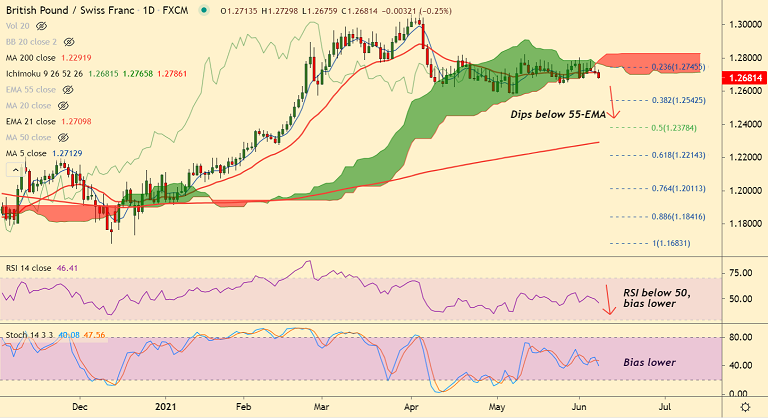

GBP/CHF chart - Trading View

GBP/CHF was trading 0.25% lower on the day at 1.2682 at around 09:50 GMT, bias bearish.

The pair is extending declines for the 3rd straight session, slips below 55-EMA support.

COVID-19 jitters and continuing Brexit woes acted as a headwind for the British pound, exerting downside pressure on the pair.

UK government's plan to reopen the economy on June 21 remains in doubt amid spread of the so-called Delta variant.

Also, with the EU reportedly considering tougher retaliatory measures if U.K. fails to implement its post-Brexit obligations, tensions run high.

GBP/CHF price action is below 200H MA and indicators on the intraday charts are bearish. Daily cloud is now stiff resistance.

The pair has slipped below 55-EMA and next bear targets lie at 1.2579 (110-EMA) ahead of 1.2542 (38.2% Fib). Bearish invalidation above daily cloud.