Before we begin with this write-up, it was advised in our recent technical post that the GBPJPY’s intermediate bull trend has been struggling. Please go through below weblink for more readings:

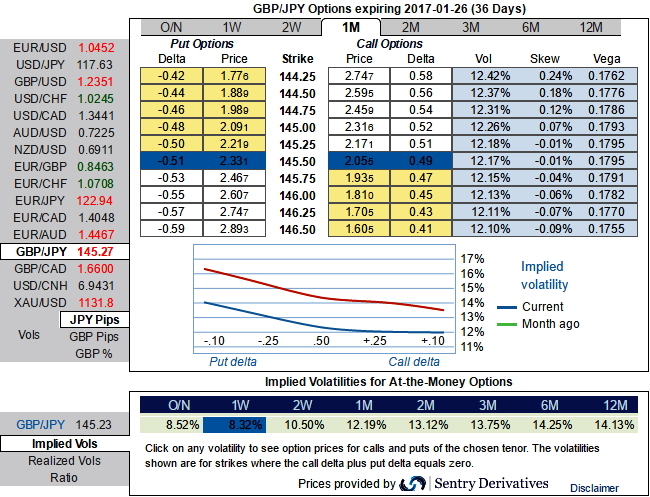

Well, in the recent times, GBP vols skews normalized too much after the Brexit votes, the GBP volatility market normalized sharply (you could observed that in GBPJPY IV skews) which is quite favorable for OTM option writers. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

The trend monitoring: the major downtrend and short-term upswings into consideration, anyone who wishes to carry long GBPJPY exposures, a collar options trading strategy is recommended. This could be constructed by holding the total number of units of the underlying spot FX while simultaneously buying the protective put and shorting call option against that holding. The puts and the calls are both OTM options having the same expiration month and must be equal in the number of contracts.

The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

Technically, the collar strategy is the equivalent of an OTM covered call strategy with the purchase of an additional protective put. Capitalizing on 1w IVs and 1m IV skews, we prefer OTM shorts that likely to reduce almost 50% cost of what you pay in the form of the premium on OTM longs.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis