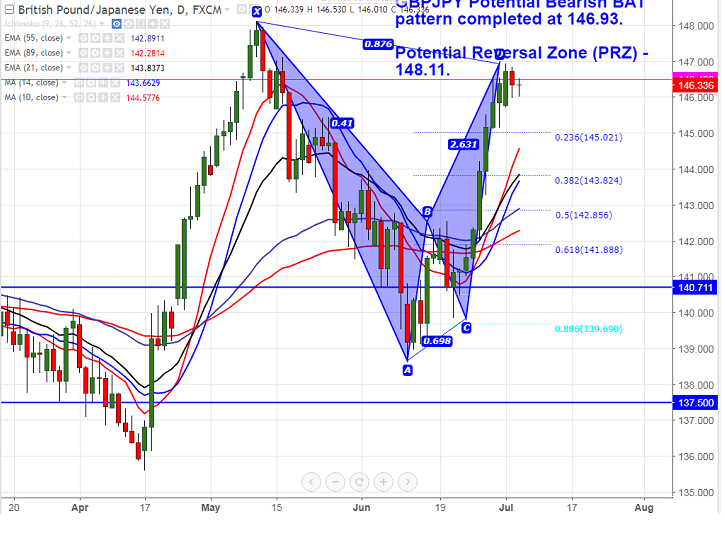

- Harmonic Pattern – Bearish Bat pattern.

- Potential Reversal Zone (PRZ)- 148.15

- GBP/JPY is consolidating in narrow range between 146.93 and 145.14 for the past three trading session. The pair formed minor bottom around 138.67 and any further weakness can be seen only below that level. It is currently trading around 146.55.

- GBP was trading weak against dollar after weaker than expected UK manufacturing PMI and construction PMI data. Market awaits UK services PMI and FOMC minutes meeting today for further direction.

- On the lower side, near term support is around 145.02 (23.6% retracement of 138.67 and146.93) and any break below will drag the pair down till 143.58 (21- EMA)/142.75 (55- EMA).

- The near term resistance is around 147 and any break above will take the pair till 148.10 (May 10th 2017)/150.

It is good to sell on rallies around 146.70-146.75 with SL around 148.11 for the TP of 144.55/142.75.