History repeats in GBPJPY at the resistance of 145.546 levels with shooting star formation, ever since then the pair has been consistently dipping that has now gone below 7EMA, resuming major downtrend back again.

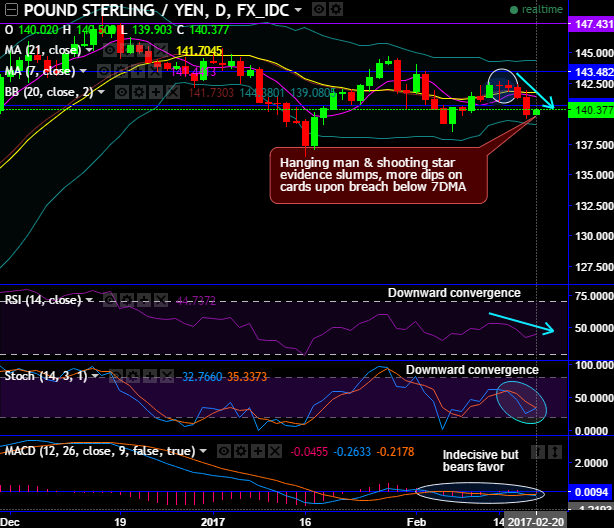

While on the daily chart, shooting star & hanging man candles occurred at 141.260 and 142.409 levels respectively, subsequently, these bearish patterns evidence slumps, more dips on cards upon breach below 7DMA.

From last two months, the pair has been dipping southwards ever since the shooting star pattern has been formed at resistances where we could the pair has rendered demand and supply sentiments at this juncture several times in the past (monthly charts).

It has now rejected the stiff resistances at 145.546 levels again to push below 7EMA curves, slumps up to the next strong support at 133.878 levels is possible.

Selling momentum on monthly terms is intensified as we can make out from the leading oscillators (RSI showing strength in bearish sentiments, while stochastic curves have been indecisive but bears favor) but clearly converging to the prevailing price slumps on daily plotting.

MACD on monthly terms also signals the extension of its downswings but indecisive on dailies.

Thus, one can speculate intraday bullish rallies but certainly not yet an investment opportunity in GBP.

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 141.4433 and lower strikes at 139.0890 levels.

On hedging grounds, initiate longs in futures contracts of mid-month tenors to arrest the potential slumps up to 133.878, keep a strict stop loss of 143.482 levels.