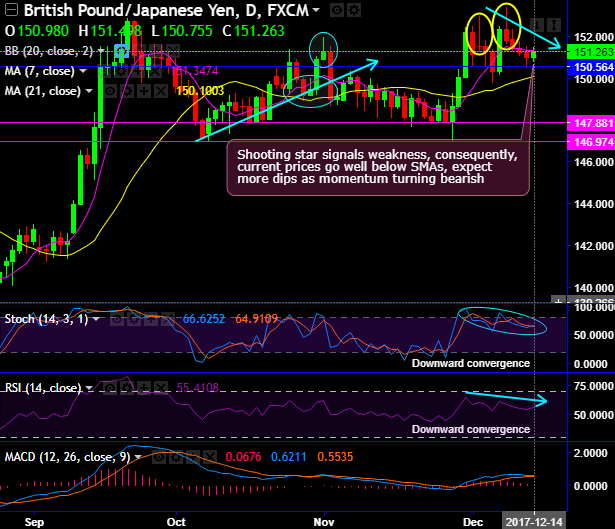

GBPJPY shooting star and gravestone doji pattern candles have been popping up quite often at the peaks of rallies (at 151.214, 151.502 and 151.835 levels on daily plotting).

The pair pops up hanging man at or near 38.2% Fibonacci retracement levels (at 152.208 levels) in the consolidation phase, ever since then the bulls seem to have given up their pace and showing weakness.

The above-stated candle patterns are bearish in nature that hamper the previous bullish momentum in the intermediate trend if the sustenance is observed likely to drag price slumps.

The current prices have gone well below 7DMAs. For now, the bulls are attempting to hang around 7DMA levels.

The stiff resistance is observed at 152.121 levels (i.e. 38.2% Fibonacci retracements).

Well on a broader perspective: In consolidation phase, any breach below EMA levels is likely to drag slumps towards 145 levels. Although we see upward convergence, the buying momentum is shrinking away on both timeframes.

The stochastic oscillator has entered into overbought trajectory but has been indecisive.

While RSI has been converging to the price drops on dailies to signal the strength in the downtrend. Whereas, monthly RSI (14) is converging upwards but trending below 62 levels that signal losing strength in the previous buying interests.

While MACD on the contrary signals indecisiveness on daily terms.

Well, overall we anchor the prevailing bearish stance is backed by both leading oscillators, one can think of shorts in this pair only for the short-term basis.

Trade tips:

For the daily trading, tunnel spread options strategy is the best suitable trading strategy, so snap the rallies to deploy higher strikes at 151.716 levels and lower strikes at 150.564 levels.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -64 (which is bearish), while hourly JPY spot index was at 139 (which is highly bullish) while articulating (at 06:20 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

The indices values are also in tandem with our analysis and the strategy advocated.

FxWirePro launches Absolute Return Managed Program. For more details, visit: