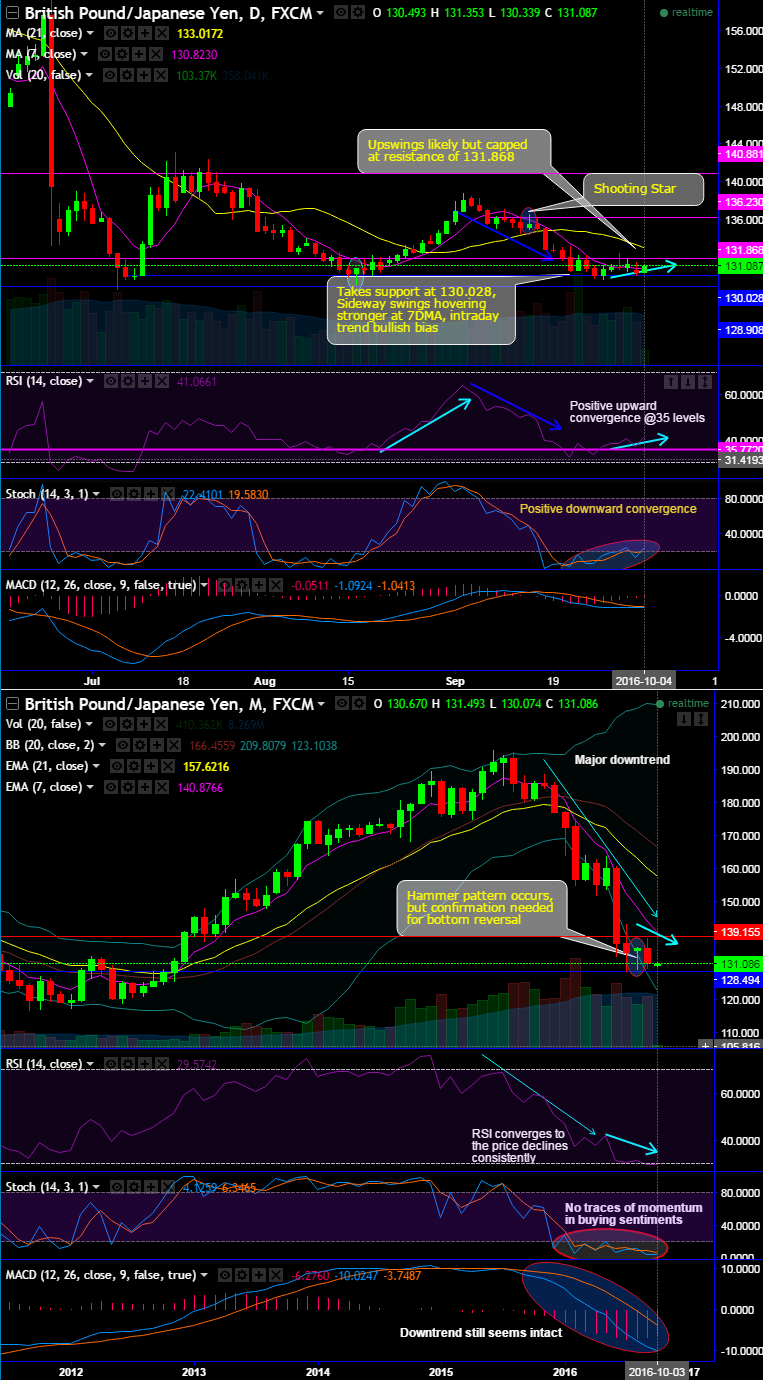

The pair takes strong support at 130.028, but drifting in sideways from last 5-6 days, hovering firmly at 7DMA, the intraday trend seems to be bullish bias, the further upswings more likely but capped at the resistance of 131.868.

From last two weeks, the pair hasn’t been moving anywhere beyond 132.27 northwards nor even 129.629 on southwards.

But prior to that, it kept tumbling after the rejection of highs of 138.831 levels to push below DMA curves on the daily chart (observe 7DMA crosses below 21DMA). Bears have managed to slide below 7EMA after gravestone pattern as well, as a result, the slumps have been dragged towards 129.629 levels.

Both RSI and stochastic signal little strength in prevailing bullish swings by evidencing positive convergence.

On a broader perspective, it seems like bulls holding stronger support at 128.500 levels ever since a hammer pattern candle has been formed but no traces of bounce back to substantiate reversal so far.

We are not isolating this signal, both leading and lagging oscillators on monthly plotting still indicate selling pressures.

The current prices have remained well below both EMA &DMAs, so downtrend would likely continue in long run amid short-term upswings.

Selling momentum is intensified as we can make out from the leading oscillators converging downwards along with the dipping prices.

While RSI (14) trending below 30 levels that signals the strength in selling interests.

Stochastic oscillators have reached oversold territory but no convincing %k crossover is seen, instead intensified selling momentum is observed. While MACD has entered into zero zones with bearish crossover, hence, we believe further price decline seems more likely.

Trade tips:

Keeping technical reasoning in mind, we reckon one can deploy boundary binary options seem best suitable at the current juncture on the intraday speculative basis for targets across 50-60 pips.

Upper strikes – 132.27; Lower strikes – 130.28 levels (i.e. immediate support), yields are certain as long as the spot FX remains between these strikes on expiration.

The trading between these strikes likely to derive certain yields in this stiff range and more importantly these yields are exponential from spot FX.