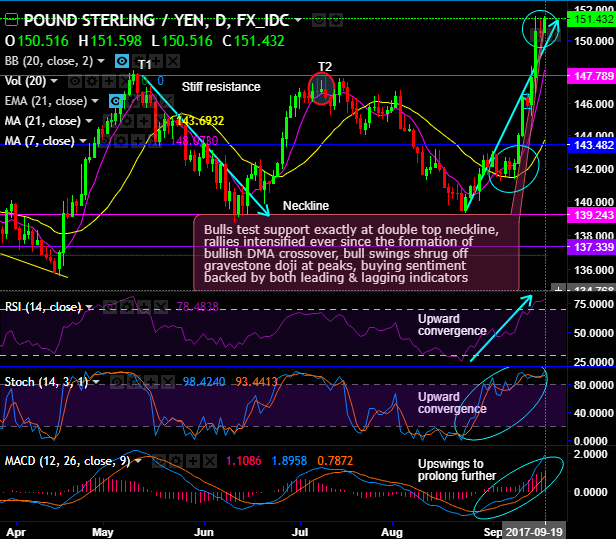

Gravestone doji has formed at 150.531 levels and the bulls have tested the support exactly at double top neckline, consequently, the rallies intensified ever since the formation of bullish DMA crossover, bull swings shrug off gravestone doji at peaks, buying sentiment backed by both leading & lagging indicators.

Although GBPJPY bull rallies seem to have been halted at 151.500-600 levels from last 2-3 days, we see no traces of bearish indications.

Both leading oscillators are approaching overbought trajectory but still shows intensified buying momentum which means ongoing bullish sentiments are likely to continue.

RSI has been showing constant upward convergence to signify the strength in rallies even above 75 levels. The stochastic oscillator is also consistently evidencing upward convergence to the price rallies on both time frames. Buying momentum is intensified on both timeframe.

To substantiate this bullish stance, MACD on the other hand, forms bullish crossover to signal the extension of bullish trend on both time frames.

Well on a broader perspective, bulls have managed to retrace above 38.2% Fibonacci levels from the lows of 123.041 levels in October 2016, for now, the consolidation phase evidences 15-months' highs after taking support at 23.6% Fibos.

Overall, the minor trend is attempting gain more upside traction despite minor hic-ups, while major trend has been robust for the consolidation phase. Thus, on speculative grounds, we advocate buying one touch binary calls and on hedging grounds, encourage longs in futures contracts of mid-month tenors in order to arresting upside risks.

Currency Strength Index: Ahead of the announcement of the UK retail sales numbers and BoJ’s monetary policies, FxWirePro's hourly GBP spot index is flashing at 133 levels (extremely bullish), while hourly JPY spot index was at shy above -170 (extremely bearish) at 06:34 GMT, these indies values are also in sync with our above technical rationale. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: