- GBP/NZD resumes upside after break out of a consolidation phase, bias higher.

- Kiwi plunges after NZ business confidence plummets to 8-year lows. While pound remains supported on renewed Brexit optimism.

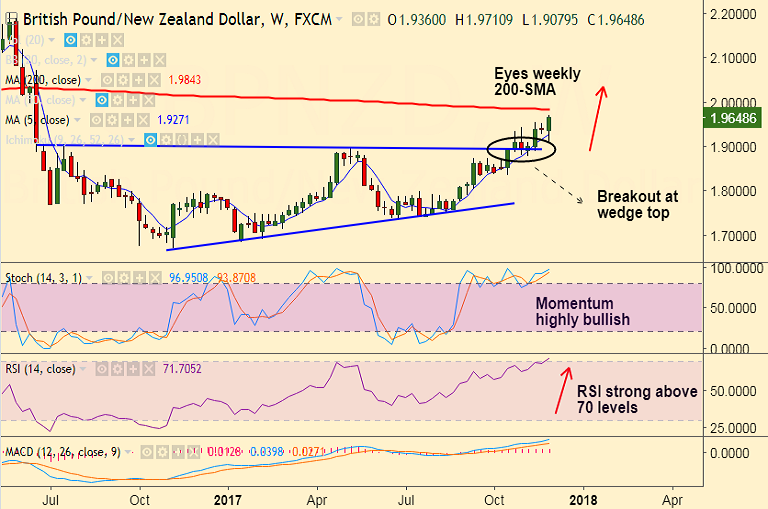

- The pair has shown a break of rising Wedge pattern and 200W SMA at 1.9843 is next likely bull target.

- Technical studies on weekly charts are highly bullish, RSI shows strength above 70 levels.

- Violation at 200W SMA will propel the pair to further highs. Scope then for test of 38.2% Fib at 1.9995.

- On the flipside, 20-DMA at 1.9210 is strong support, decisive break below invalidates our bullish bias.

Support levels - 1.9418 (5-DMA), 1.9210 (20-DMA), 1.9079 (Nov 28 low)

Resistance levels - 1.9843 (200W SMA), 1.9995 (38.2% Fib retrace of 2.53187 to 1.67049 fall), 2.0357 (June 13 week high)

Recommendation: Good to go long on dips around 1.9590, SL: 1.9410, TP: 1.9843/ 1.9995/ 2.0350

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 71.9613 (Neutral), while Hourly NZD Spot Index was at -48.7006 (Neutral) at 1100 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest