- GBP/NZD has resumed upside after brief consolidation in the previous session.

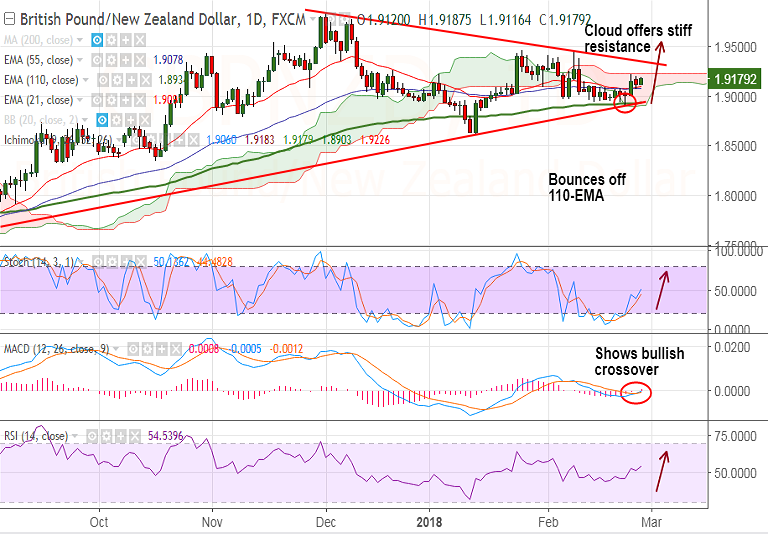

- Price action finds strong support at nearly converged 21 and 55 EMAs at 1.9078.

- The pair is trading in a 'Symmetric Triangle' pattern, has bounced off strong support at 1.89 (major trendline support).

- Technical indicators are turning higher. Stochs have rolled over from oversold levels.

- MACD is showing a bullish crossover on signal line and RSI is biased higher and above 50 levels.

- Upside finds stiff resistance at daily cloud top at 1.9226, breakout above could see further upside.

- Next major resistance lies at 1.9365 ('Triangle Top'). Violation there could see further upside.

Support levels - 1.9091 (21-EMA), 1.8933 (converged 110-EMA and Triangle base), 1.89 (Feb 22 low)

Resistance levels - 1.9226 (cloud top), 1.93, 1.9365 (Triangle Top), 1.9454 (Feb 8 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-NZD-holds-above-110-EMA-good-to-go-long-on-dips-1168422) is progressing well.

Recommendation: Bias higher. Hold for targets

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -6.68741 (Neutral), while Hourly NZD Spot Index was at -165.291 (Bearish) at 0440 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest