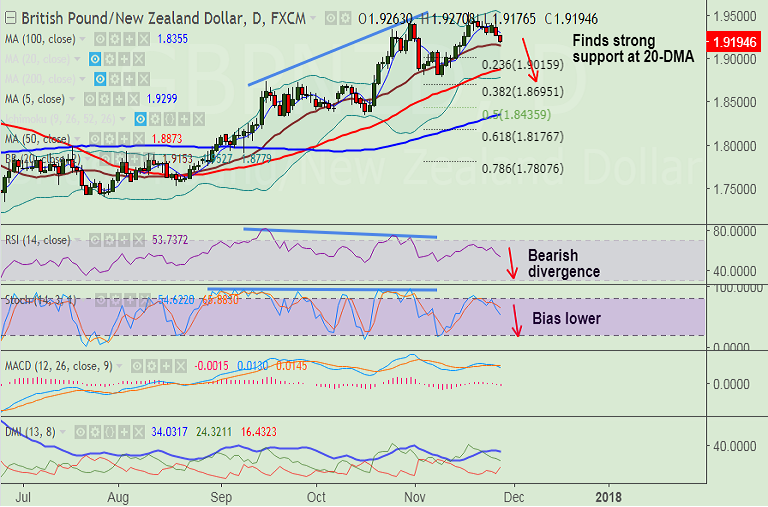

- GBP/NZD is retracing from 16-month highs of 1.9534 hit on Nov 17th.

- The pair has slipped below 5-DMA and is currently holding above strong support at 20-DMA at 1.9153.

- Break below will see further weakness, scope then for test of 50-DMA at 1.8873.

- Technical indicators are turning bearish, RSI and Stochs have turned south we see scope for further weakness.

- We evidence bearish divergence on RSI and Stochs from price action which adds to the bearish bias.

Support levels - 1.9153 (20-DMA), 1.9015 (23.6% Fib retrace of 1.7337 to 1.9534 rally), 1.8873 (50-DMA)

Resistance levels - 1.9297 (5-DMA), 1.9432 (Oct 31 & Nov 27), 1.9534 (Nov 17th high)

Recommendation: Good to go short on break below 20-DMA at 1.9153, SL: 1.93, TP: 1.91, 1.9015, 1.8875.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -86.2745 (Bearish), while Hourly NZD Spot Index was at 134.066 (Bullish) at 1100 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest