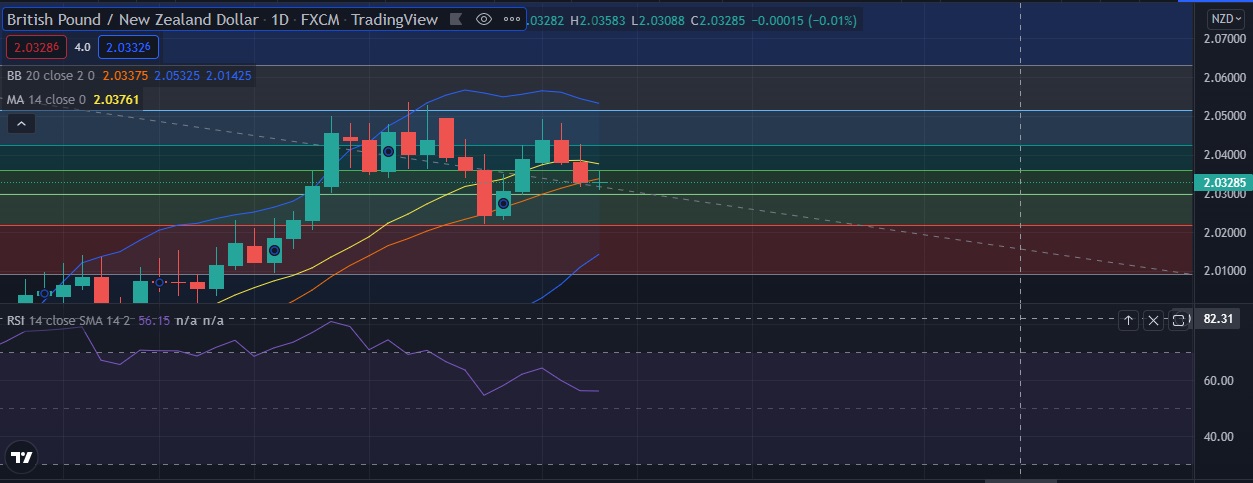

• GBP/NZD declined on Wednesday as higher oil prices and increased risk appetite lifted New Zealand dollar.

•The pair reaches 2.0320 after extending south from 2.0417 (early Asia high). 2.0320 is the lowest level since 11th February.

• Technical signals show the pair could lose more ground RSI is turning lower, daily momentum studies 5, 10 and 21 DMAs are trending down.

• Immediate resistance is located at 2.0360 (50%fib),any close above will push the pair towards 2.0424 (61.8 % fib ).

• Immediate support is seen at 2.0300 (38.2% fib) and break below could take the pair towards 2.0218 (23.6%fib)

Recommendation: Good to sell below 2.0320, with stop loss of 2.0440 and target price of 2.0200