• GBP/NZD strengthened on Tuesday as strong UK employment data supported GBP against kiwi dollar

• Employers added a record 184,000 staff to their payrolls in December, while the headline unemployment rate for the three months to November dropped to 4.1%.

• At GMT 18:38, the pair was trading 0.04% higher at 2.0097, slightly lower from session high at 2.0156

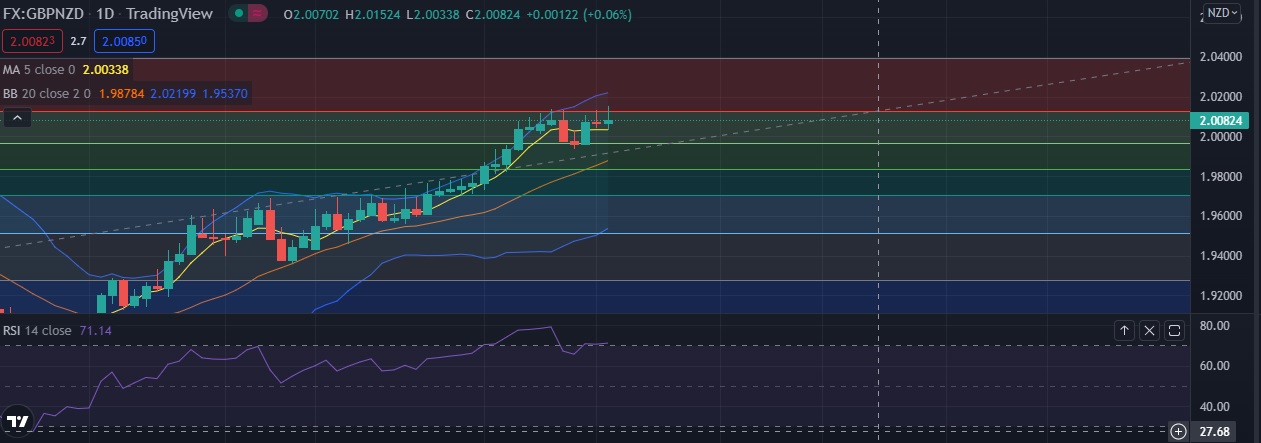

• Technical signals are bullish as RSI is at 72, daily momentum studies 5,9,21 DMA are trending north.

• Immediate resistance is located at 2.0132 (23.6%fib ), any close above will push the pair towards 2.0222 (Higher BB).

• Strong support is seen at 2.0033 (5DMA) and break below could take the pair towards 1.9968 (38.2%fib).

Recommendation: Good to buy on dips around 2.0060 with stop loss of 1.9960 and target price of 2.0150