Trade-weighted Sterling Sinks to 2-year Low.

Gains against the U.K. currency helped the dollar hold above recent lows.

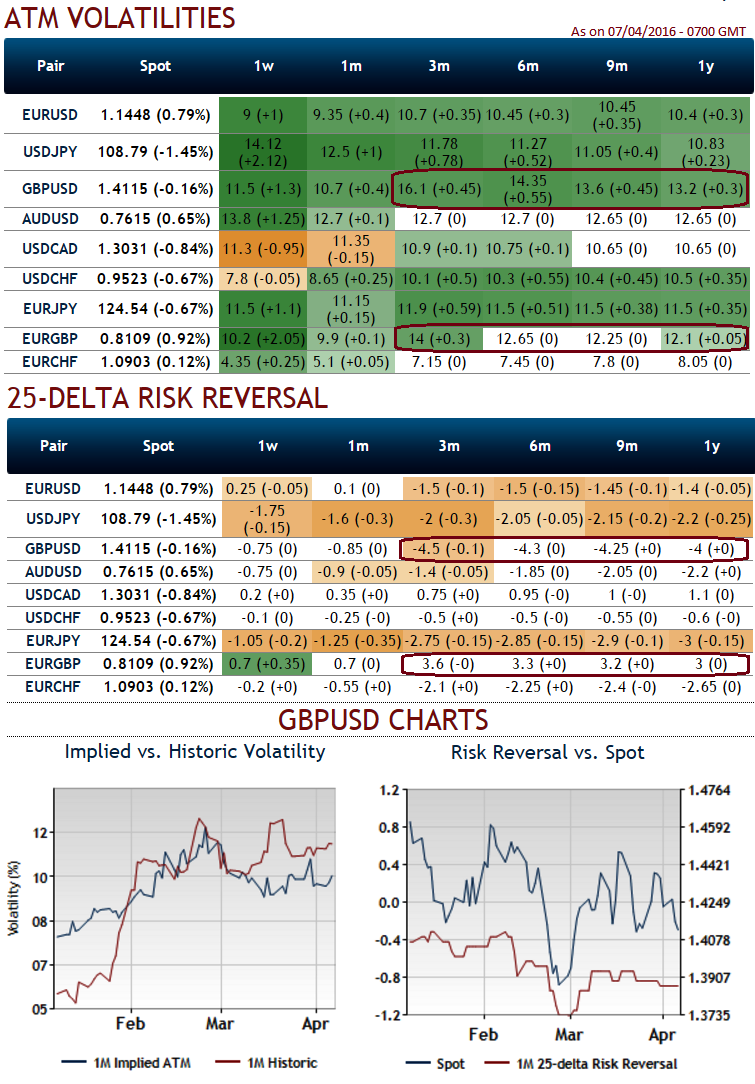

3M ATM IVs of GBPUSD and EURGBP spiking above 16% and 14% respectively.

Brexit concerns sent euro/sterling 3-month implied volatility to 7-year high of 14%, (UK referendum scheduled on 23rd June which is approximately 2and half months from now).

These implied volatilities can be interpreted as relative over or under-pricing of options by the market. The charts above demonstrate one month historic volatility versus the one month at-the-money volatility quoted by the market for option prices.

With potential “Brexit” looming and global economic headwinds showing few signs of abating, real GDP growth in the United Kingdom may remain soft, albeit positive, in the coming quarters.

While GBPUSD and EURGBP makes lot of noises in FX OTC option markets for next 3 months tenors as per the risk reversal.

The spot FX curves of these two pairs seem to have been converging to the OTM IVs.

That signals the chances of 3M longs in OTM contracts are most likely to become in the money on expiration.

This is evident if you observe that the sterling against dollar has been collapsed almost about 11.67% in last 10 months, observing at the current GBP environment we could foresee more room for hedging its depreciation.

From last 1 week, GBPUSD shows loss of 2.69%, a drop from highs of 1.4459 to the current 1.4070 levels.