PM May's vision for UK's clean break from the EU may have removed uncertainty around the Britain’s stance on the issue, but not made Article 50 talks any less thorny or reduced tail risks of a disorderly Brexit. GBPUSD digital puts, GBPCHF 2Y vol and cable 6M6M FVAs are well priced as hedges.

Her speech eliminated any lingering doubts that the UK will pursue a different future outside Europe, and in theory, this removal of uncertainty around the British stance should prove bearish for GBP volatility.

GBPUSD forward volatility (FVAs): Forward volatility is useful to own as a hedge against a political process that is difficult to pin down in terms of timing and hence demands option expressions that can stay alive without rapidly stopping out on theta decay.

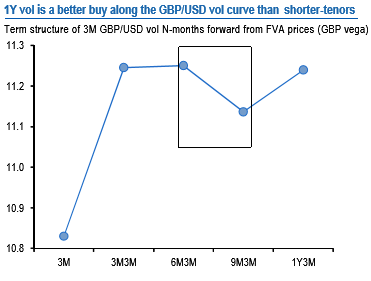

FVAs are essentially gamma-neutral, long vega calendar spreads and efficient in this regard; 1Y tenor GBPUSD vols, in particular, are cheap relative to surrounding points on the curve (refer above chart) and worth owning via 6M6M or 9M3M FVAs that age well as a result of minimal/zero slide along the curve.

Despite the relative cheapness of GBPCHF vols vis-a-vis GBPUSD, the latter is a more realistic target for FVA structures on liquidity grounds.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation