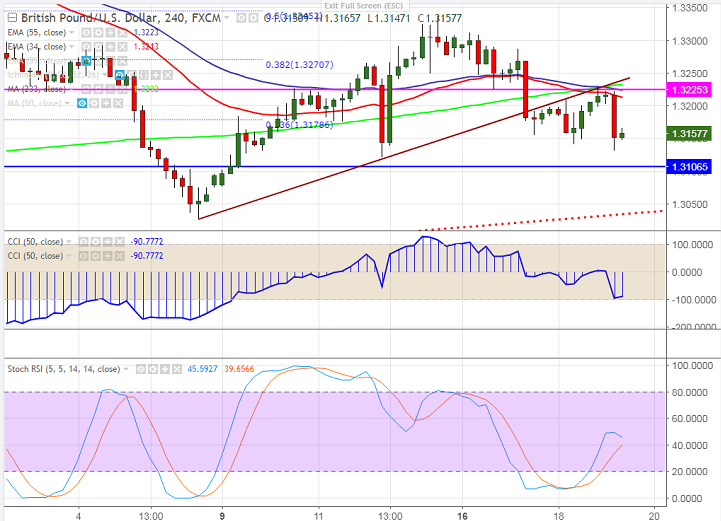

- Cable has shown a further decline after UK retail sales data. Britain’s retail sales came at much lesser than expected. According to official figure, total sales across the retail sector declined by 0.8% compared to -0.1%. Pound sterling hits intraday low of 1.3312 and is currently trading around 1.31569.

- The near term major resistance is around 1.3229 (55-4 H EMA) and any break above will take the pair to next level till 1.3300/1.3325 (20- day MA)/1.3400. The minor resistance is around 1.3180.

- On the lower side, 1.3120 (Oct 12th low) will be acting as major support and any break below will drag the pair down till 1.30750/1.30270 level. Bearish continuation can be seen only below 1.3030.

It is good to sell on rallies around 1.3175-80 with SL around 1.3230 for the TP of 1.3075/1.3030.