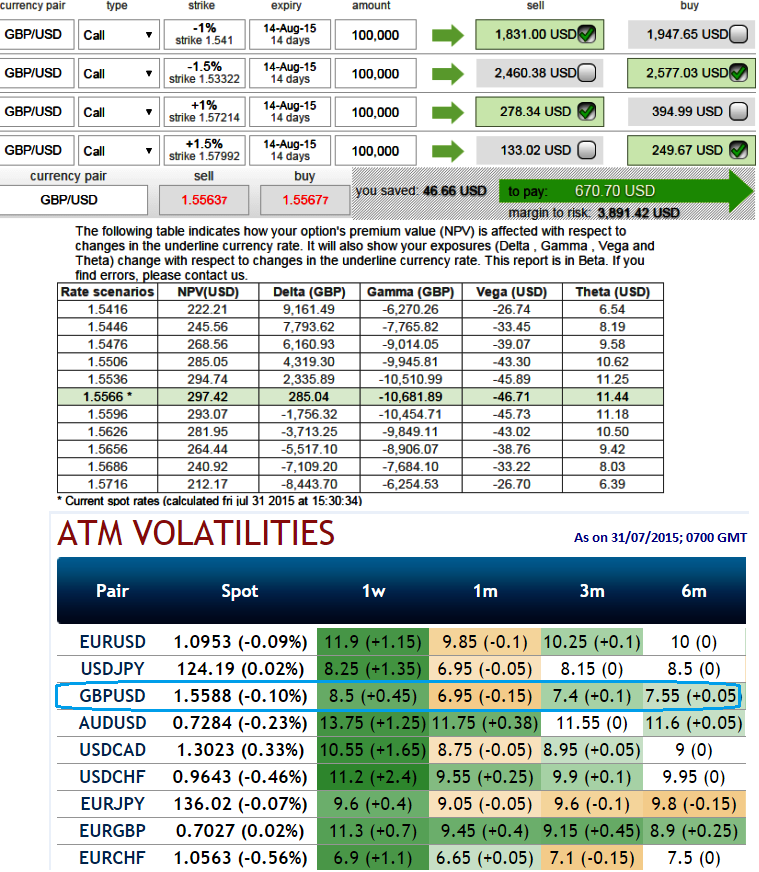

As there are no significant data releases that would propel GBP side for this week and near future GBPUSD may likely to experience low volatility. You can make out from the nutshell; GBPUSD is to have the 2nd lowest IV.

Currency option strategy through Condor construction: GBP/USD

Since the GBPUSD's implied volatility is perceived to be comparatively minimal, so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

The trader can construct a long condor option spread as follows ideally for the short call spreads to expire worthless. As shown in the figure, the trader can implement this strategy using call options with similar maturities.

So strategy goes this way, writing 14D (-1%) In-The-Money call and buying 14D deep striking (-1.5%) In-The-Money calls, writing 14D higher strike (1%) Out-The-Money calls and buying 14D another deep striking (1.5%) Out-Of-The-Money call for a net debit.

FxWirePro: GBP/USD low IV portrays condor spreads for risk averse

Friday, July 31, 2015 10:10 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?