Over the next few months, GBP is likely to continue trading on the back-foot. Sterling may have cheapened considerably since the Brexit referendum in June 2016, but the sizeable current account deficit remains an albatross around its neck, while real UK yields are notably low. Consequently, GBP crosses have also been flashing tepid vols.

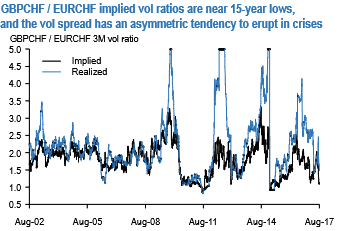

GBPCHF – EURCHF vol spreads: GBPCHF vs EURCHF vol ratios are approaching 15-year lows, nearly at par with extremes first witnessed at the height of the EMU crisis in the fall of 2011 that brought on the 1.20 peg in the first place, and then revisited when it was removed two years ago (refer above chart). Owning the vol spread has a desirable positive asymmetry from current levels, a tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, and enjoys small positive carry at inception (2M ATM vol spread 0.7 mid, 1-mo realized vol spread 1.5).

It should not escape attention too that the RV is fairly well-insulated from SNB-shenanigans: chart 7 digs forensically into the return profile of vol spreads initiated every day in the months leading up to and spanning the 2015 de-peg shock, and surmises that the mean return around the episode was positive to the tune of 2 vol pts., with an appreciable positive skewness.

The results are not entirely surprising since GBPCHF’s higher risk-beta compared to EURCHF imparts an anti-risk bias to the spread that manifests in its predictable crash sensitivity in above chart, and is handy in the current context when GBP faces idiosyncratic Brexit risks and unpredictable market reaction to potential BoE rate hikes amid growth weakness. Hence, GBPCHF – EURCHF 2M ATM straddle spreads are advocated @ 0.75/1.0 vol indic. offer. Source: JP Morgan

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts