A few words on Brexit sentiments: Aren’t you aware of the sentiments of lingering sentiments that can never be disregarded? The threat that gradually but certainly spreads through your some part of the economy and then drastically tingles everywhere, despite all rationality? Yes, we refer to the impression that the financial markets currently feel like that following the Brexit vote. Initially, there was the shock of the incredible, then the calm, reasonable arguments that nothing much would change for the time being and finally the slowly spreading lingering fear that we may see an economic, property or even financial market crisis.

Macroeconomic Fundamentals:

UK growth outlook has been hit by mounting Brexit risks and policy uncertainties.

A BoE rate cut appears imminent as policymakers look for a weaker currency to help support the economy. Mark Carney, governor of the Bank of England (BoE), fuelled fears further when he pointed out the possible risks following the presentation of the BoE’s semi-annual Financial Stability Report - amongst these the current account deficit.

The weaker growth and lower rate outlook is compounded by a very large current account deficit.

Sterling is expected to weaken further, bottoming in the low 1.20s in early 2017, as the Fed readies to hike.

Technicals:

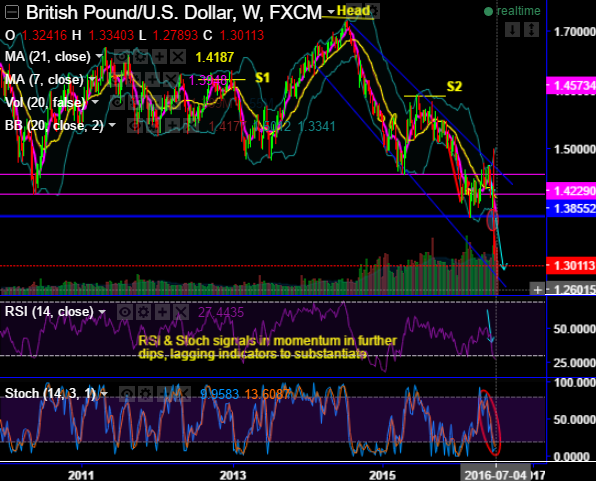

Supports in GBP/USD are broken, one after another, which is symptomatic of downside momentum ramping up. Indeed, after breaking below the 35-year support zone of 1.3850/1.35 and therefore confirming a massive Head and Shoulder pattern, GBP/USD just breached 1.30, the 76.4% retracement of the uptrend which took place from 1985 low to 2007 high.

Short-term resistances are placed at 1.3040/1.3080, the 2-year down sloping channel lower limit (blue dash line) now broken, and 1.3230/50, the recent lows and the 61.8% retracement level of the last fall. Projections for the on-going down move define supports at 1.2675, 1.2570 and 1.2450.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock