The British economy advanced 0.5 pct on quarter in the three months to September of 2016, slowing from a 0.7 pct expansion in the previous period and in line with the preliminary estimate. Net external demand was the main driver of growth, while household expenditure and fixed investment rose at a slower pace.

But GDP forecast for 2017 has been revised up to 1.0% and remove our call of a rate cut early next year. Rather, we expect the BoE to remain on hold over the forecast horizon.

We also highlight that trend growth has decreased in recent years to about 1.5% today. Brexit, if anything, poses downside risks to this estimate.

Inflation and retail sales data released this week came in on the strong side, while the labor market report showed that employment fell and claimants increased.

The discounted gloomy UK outlook both prevents a new bold depreciation and a much stronger currency. The technical picture suggests a new turbulence and bearish pressures.

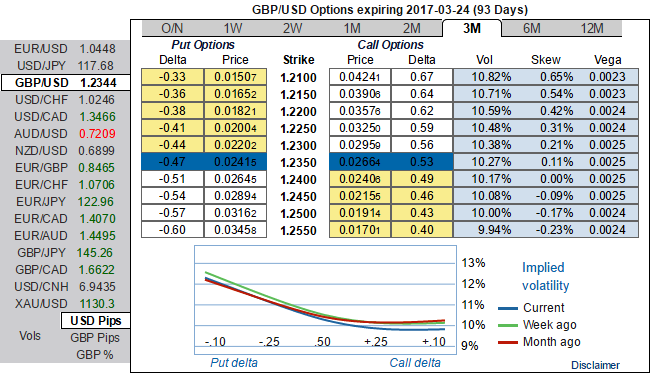

Owing to the above fundamental factors, GBP vols and risk reversals have been unchanged but to remain negative flashes to mitigate bearish risks in long run, while IV skews are also bidding OTM put strike which is line with the risk reversal indications.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?