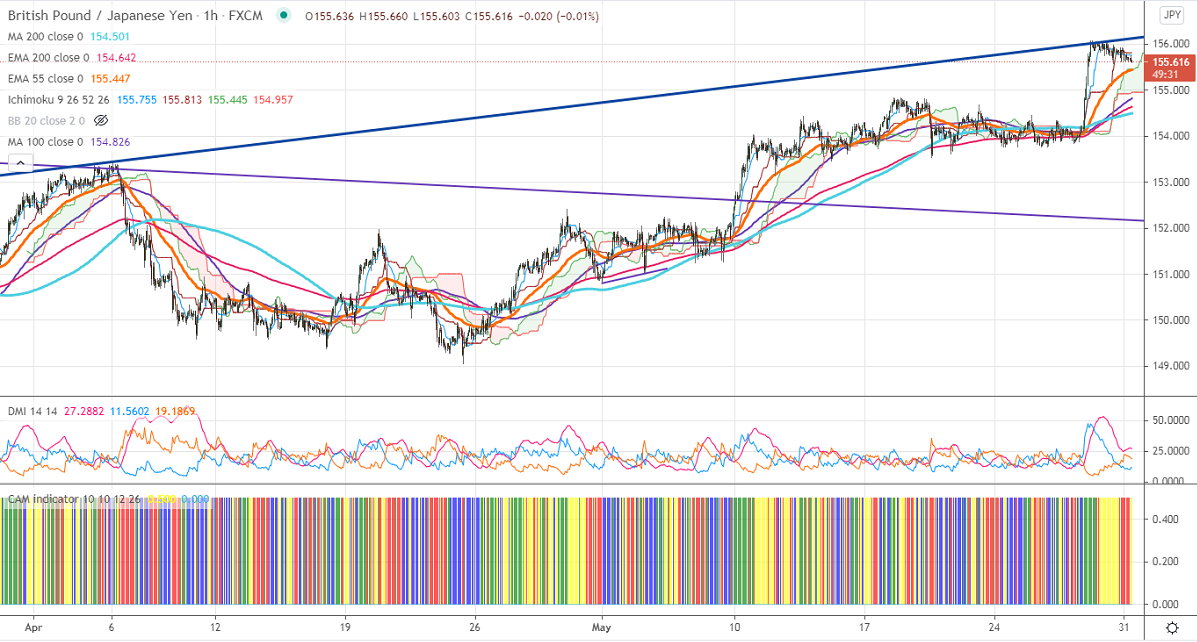

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 155.76

Kijun-Sen- 155.81

GBPJPY is trading higher for the fifth consecutive week and jumped more than 500 pips on weak yen. USDJPY recovered sharply from a minor bottom 107.47. Any surge past 110.20 confirms a bullish continuation. GBPUSD is still holding below 1.420 levels on delay in the final stage of COVID lockdown. The number of Indian corona variants doubled in two weeks in the UK. The intraday trend of GBPJPY is bullish as long support 154.50 holds.

Technical:

The pair's near-term resistance around 156.60, any break above confirms that pair downside got completed at 124.02. A jump till 157.50/158 is possible. On the lower side, near-term support is around 155.40. Any indicative violation below that level will drag the pair down to 154.98/154.35/153.75/153. Significant trend reversal only if it breaks below 153.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen and cloud.

Indicator (1-Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to buy on dips around 155 with SL around 154 for a TP of 157.50.