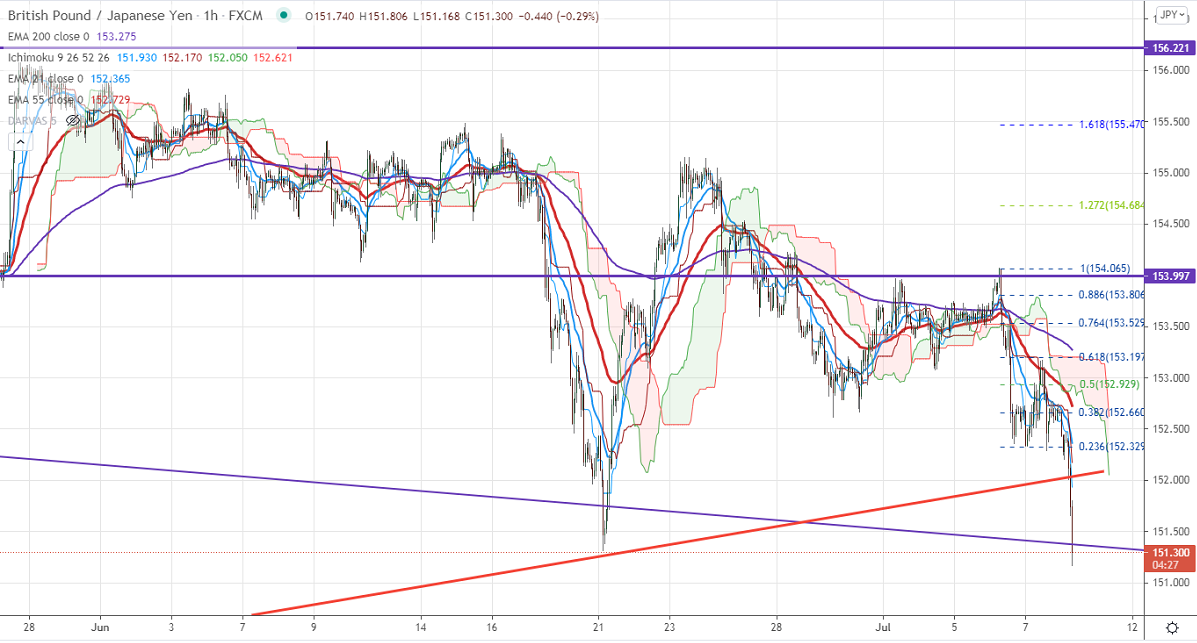

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 152.20

Kijun-Sen- 152.40

June month low – 151.30

GBPJPY continues to trade weak after a minor pullback to 153.17. The sell-off in pound sterling is putting pressure on this pair at higher levels. The surge in the number of new cases in the UK might delay the reopening of the economy in the UK. The yen gained strength on declining US bond yield. USDJPY is facing strong support around 110.20, any breach below targets 109.80. GBPJPY hits an intraday low of 151.81 and is currently trading around 151.829.

Technical:

The pair's near-term resistance around 152.50, any break above targets 152.92/153.20.Significant bullish continuation if it breaks 154.25. On the lower side, near-term support is around 151.80. Any indicative violation below targets 151.30/150.80/150. Significant trend reversal only if it breaks below 151.30.

Ichimoku Analysis- The pair is trading belowTenken-Sen and below Kijun-Sen.

Indicator (1-Hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 152 with SL around 153 for a TP of 150.