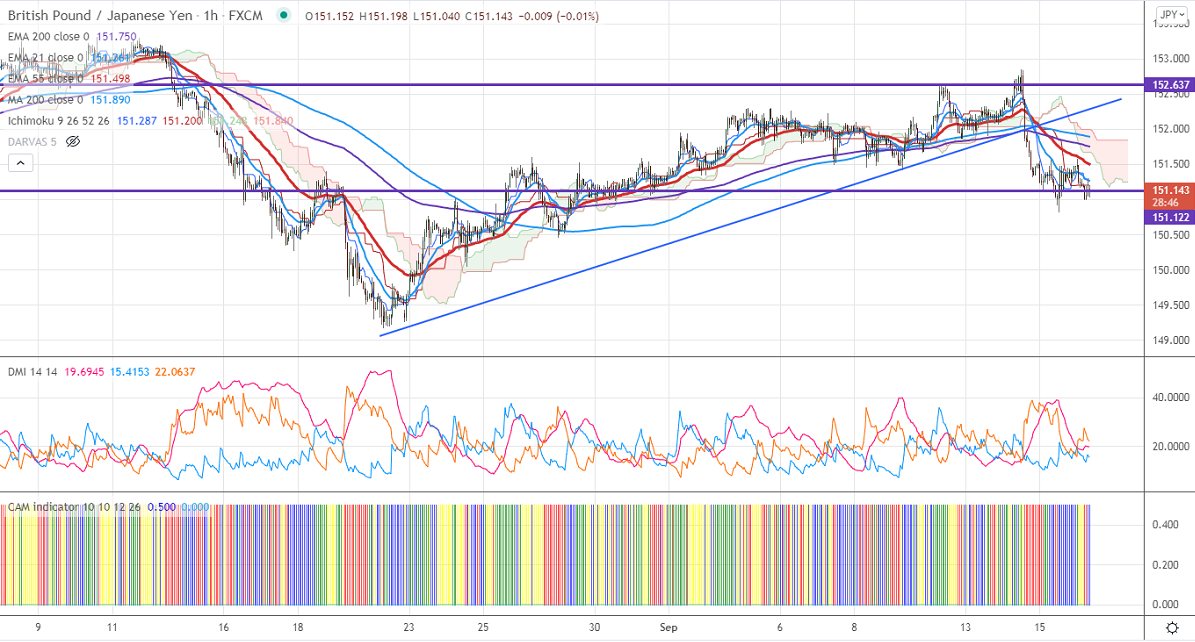

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 151.28

Kijun-Sen- 151.20

Major Intraday resistance -152.65

Intraday support- 151.80

GBPJPY has once again declined after a minor pullback to 151.57. The pair surged more than 70 pips after better than expected UK CPI data. This has increased the expectations of a rate hike by the Bank of England. GBPUSD is trading above 1.3800 levels. But Brexit concerns are preventing the cable from further upside. The intraday trend of GBPJPY is bearish as long as resistance 152 holds.

USDJPY- Analysis

The pair is hovering near multi-week lows on a minor decline in US treasury yields. The overall trend is bearish as long as resistance 110.80 holds.

Technical:

The pair's immediate resistance is around 151.52, any surge above targets 151.90/152.30/152.85/153/153.50/154.10. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 150.80. Any indicative violation below targets 150.45/150/149.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen and below Tenken-Sen

Indicator (Hourly chart)

CAM indicator- Bearish

Directional movement index –Neutral

It is good to sell on rallies around 151.80-85 with SL around 152.25 for a TP of 149.