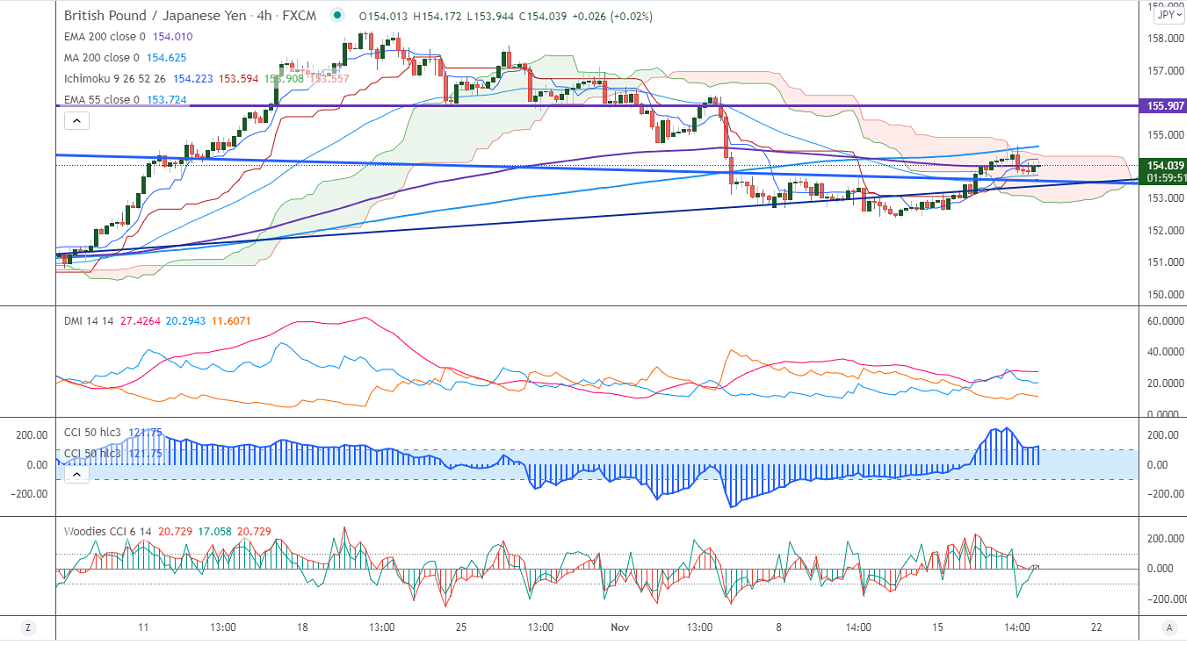

Major Intraday resistance -154.76

Intraday support- 153.74

GBPJPY lost nearly 100 pips from minor top 154.74 on strong yen.GBP is holding above 1.3500 levels on upbeat UK employment details and strong CPI data. The hopes of a Bank of England rate hike also support the Pound sterling. The intraday trend is bullish as long as support 153.50 holds. It hits an intraday high of 154.17 and is currently trading around 154.11.

USDJPY- Analysis

The pair is trading weak after hitting a multi-month high at 114.97. Any breach below 113.80 confirms intraday bearishness.

CCI Analysis-

The CCI (50) and Woodies CCI are holding above zero level in the 4-hour chart. It confirms a minor bullish trend.

Technical:

The immediate resistance is around 154.75, any break above targets 155.35/156. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 153.75 Any indicative violation below targets 153/152.50/152.18/151.60.

Indicator (4-Hour chart)

Directional movement index –Bullish

It is good to buy on dips around 154 with SL around 153.40 for a TP of 155.35.