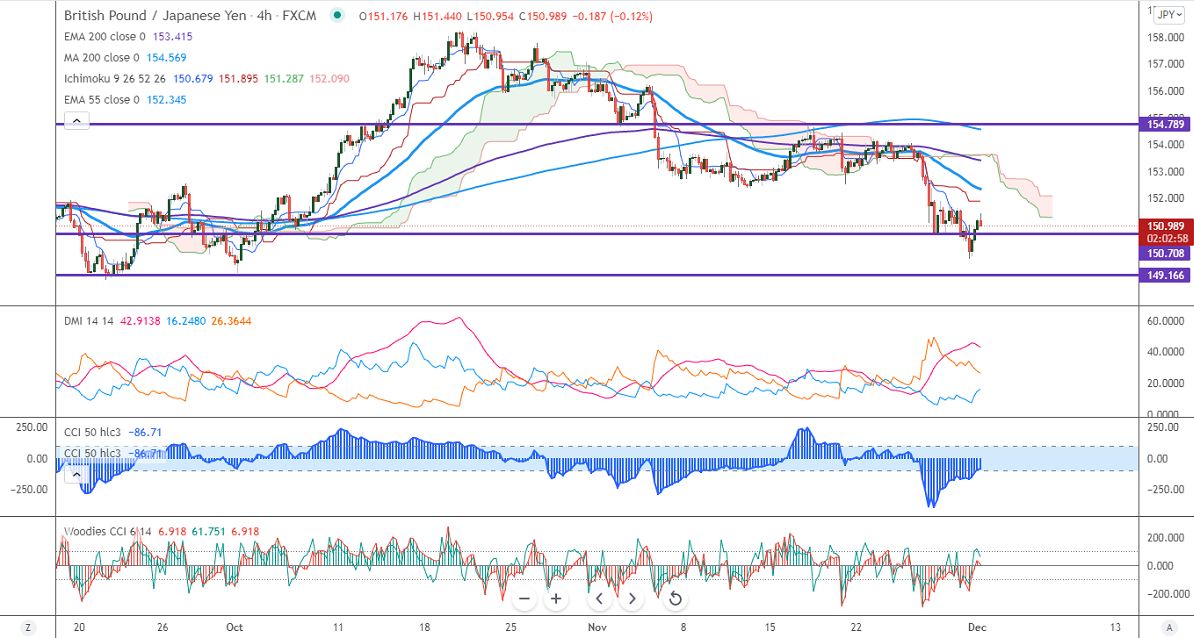

Major Intraday resistance -152

Intraday support- 149.70

GBPJPY has halted its two weeks of losing streak and surged more than 100 pips on the strong Pound sterling. GBP recovered against all majors on positive Brexit news from France and board-based US dollar selling. Any breach above 1.3380 confirms intraday bullishness. Markets eyes spread of Omicron virus and UK final manufacturing PMI data for further direction. The intraday trend of GBPJPY is neutral as long as resistance 152 holds. It hits a high of 151.44 at the time of writing and is currently trading around 151.11.

USDJPY- Analysis

The pair pared some of its gain made today despite a decline in US treasury yield. Any breach below 113 confirms a bearish continuation.

CCI Analysis-

The CCI (50) and Woodies CCI are holding below zero level in the 4- hour chart. It confirms a major bearish trend.

Technical:

The immediate resistance is around 152, any break above targets 152.50/153/153.45/154/154.75. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 150.70. Any indicative violation below targets 150/149/148.

Indicator (4-Hour chart)

Directional movement index –Bearish

It is good to sell on rallies around 151.55-60 with SL around 152.55 for a TP of 149.