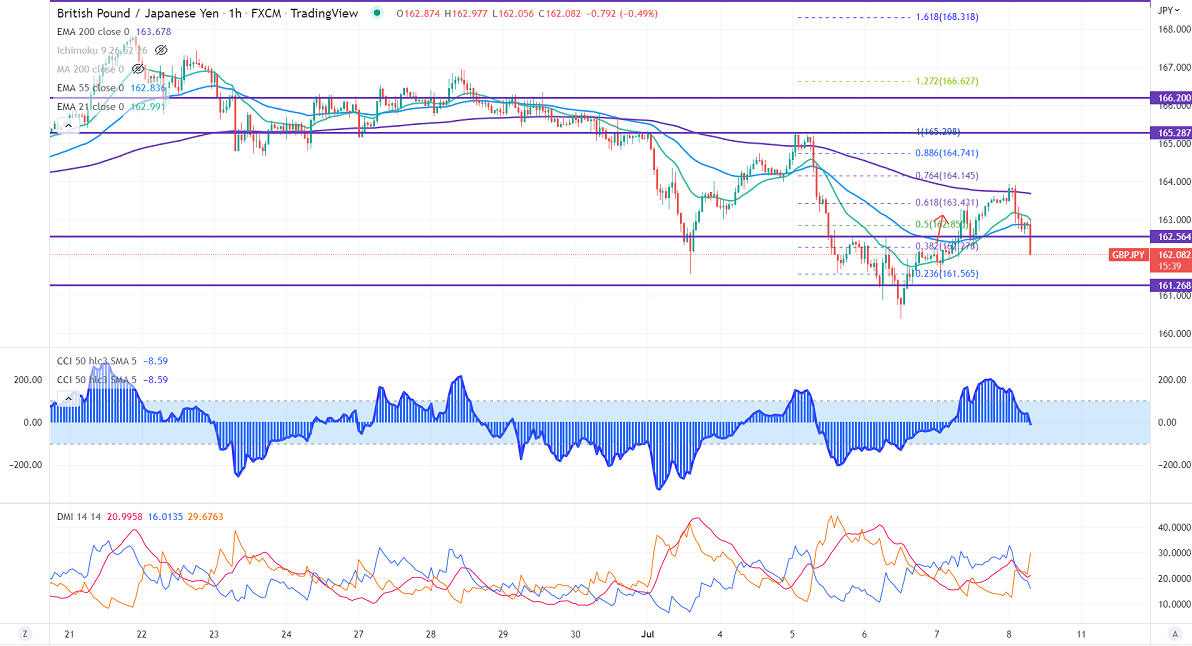

GBPJPY lost its shine after a minor pullback to 163.92. The pound sterling pared some of its gains made after UK PM Boris Johnson Quits as Tory leader. Markets eye US Non-farm payroll and UK political development for further direction. Any daily close below 1.19000 confirms a bearish continuation. Technically in the 1-hour chart, the pair is holding below short-term 21-EMA, 55 EMA, and long-term 200 EMA (162.85). Any hourly close below 162.80 will drag the pair down to 162/161.50/160. GBPJPY hits an intraday low of 162.15 and is currently trading around 162.148.

The near-term resistance is around 162.60, any breach above targets 164/165/165.30.

Indicators (1-hour chart)

CCI (50) - Bearish

ADX- Bearish

It is good to sell on rallies around 162.20-25 with SL around 163 for TP of 160.