GBPJPY took support near 55-4H EMA and surged more than 100 pips on a weak yen. The policy divergence between US Fed and BOJ puts pressure on the yen. The pound sterling showed a pullback from a minor bottom of 1.17598 amid political uncertainty and recession worries. Markets eye US retail sales data for further direction.

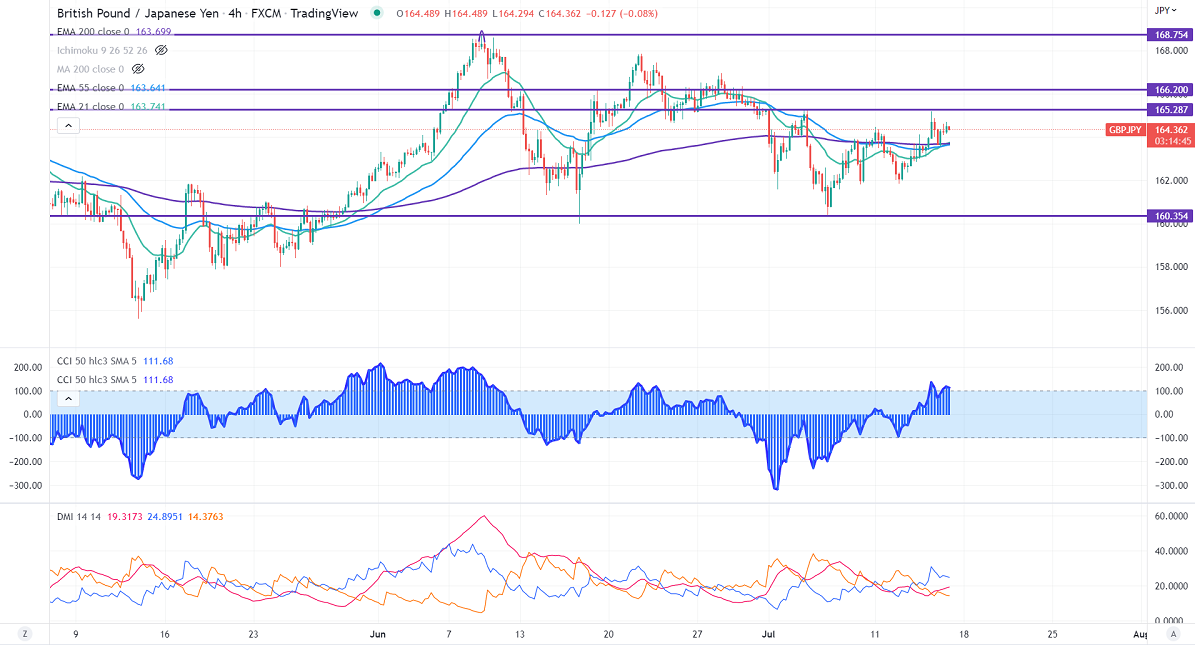

Technically in the 4-hour chart, GBPJPY the pair is holding above short-term 21-EMA, 55 EMA, and long-term 200 EMA (163.69). Any breach above 165.20 will take the pair to next level to 166/167. GBPJPY hits an intraday high of 164.70 and is currently trading around 164.35.

The near-term support is around 163.45, any violation below targets 163/162.35/161.80.

Indicators (4-hour chart)

CCI (50) - Bullish

ADX- Neutral

It is good to buy on dips around 163.55-60 with SL around 163 for TP of 165/166.