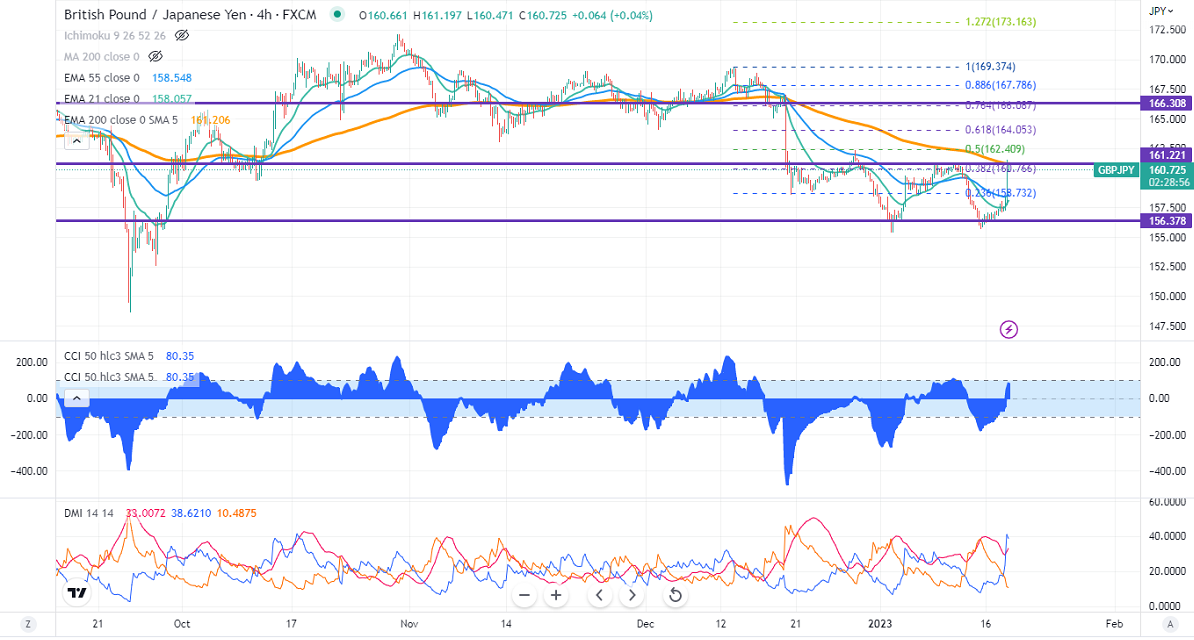

GBPJPY surged more than 400 pips on the weak yen. It hits an intraday high of 161.52 and is currently trading around 160.75.

GBPUSD- Trend- Bullish

The cable breaks significant resistance at 1.2300 after weak UK CPI. The inflation declined to 10.5% YoY in Dec, below the forecast of 10.6%. Monthly CPI came at 0.40% in line with the estimate of 0.40%. Any daily close above 1.2280 will take the pair to 1.2350/1.2440.

USDJPY- Bearish

The pair was one of the best performers yesterday after dovish BOJ. The central bank has kept its yield curve control policy unchanged. Major resistances are 131.80/132.80.

GBPJPY analysis-

The near-term support is around 160, a breach below targets of 159.30/158.46. The immediate resistance is around 161.60, any violation above will take the pair to 162.35/163.

Indicators (4-hour chart)

CCI (50) –bullish

ADX- Bullish

It is good to buy on dips around 160 with SL around 158.50 for a TP of 163.