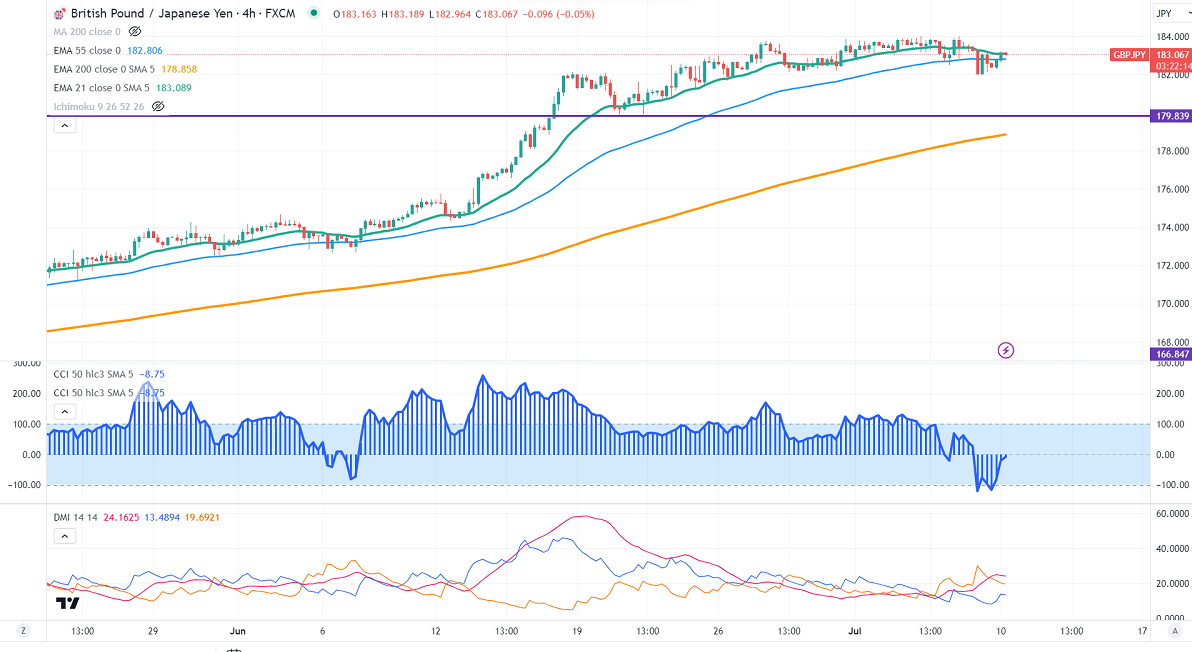

GBPJPY is consolidating in a narrow range between 184.01 and 182 for the past three days. It hits an intraday high of 183.21 and is currently trading around 183.05.

GBPUSD- Trend- Bullish

The pound sterling surged sharply after weak US jobs data. The US economy added 209000 jobs in June, the lowest since Dec 2020. Markets eye BOE Bailey for further direction. Any break above 1.2850 confirms intraday bullishness.

USDJPY- Bullish

The pair pared some of its gains despite surging US treasury yields. Significant Resistance is 143.50/145.

GBPJPY analysis-

The near-term support is around 182, a breach below targets 181.65/181. The immediate resistance is at 184, any violation above will take the pair to 185/186.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to buy on dips around 183 with SL around 182 for a TP of 185.