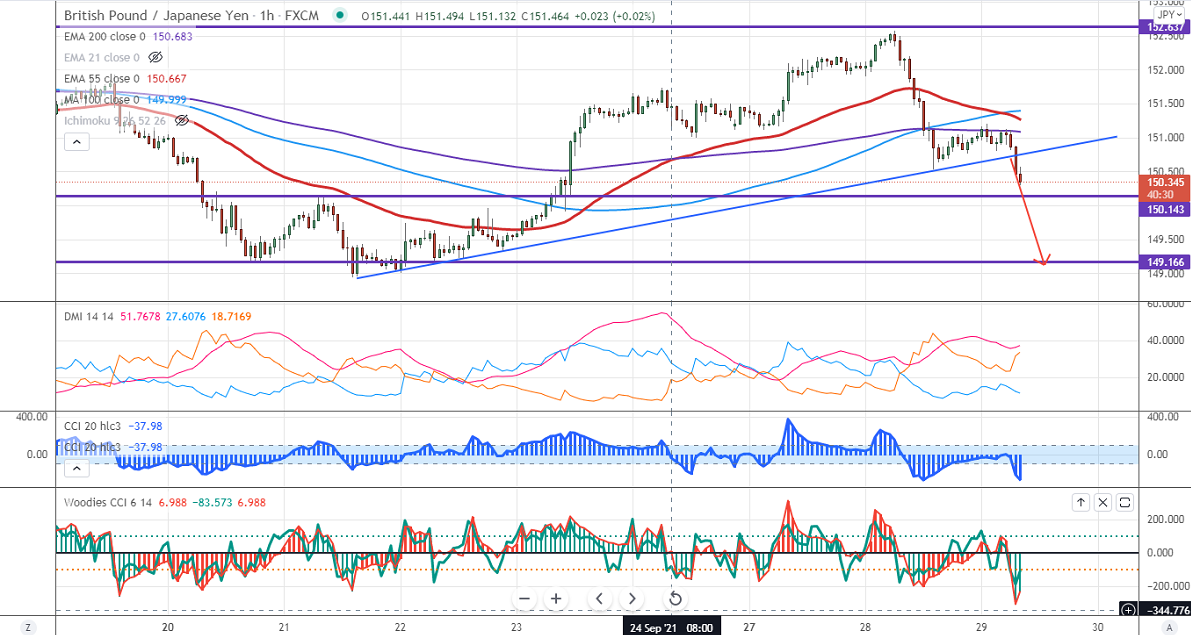

Major Intraday resistance -151.50

Intraday support- 150

GBPJPY continues to trade weak and lost more than 200 pips on board-based pound sterling selling. The pound sterling is trading below 1.3600 levels against the US dollar on Brexit concerns and the fuel crisis in the UK. The surge in US treasury yield after Janet Yellen comments on the debt ceiling also supporting the US dollar at lower levels. GBPJPY hits an intraday low of 150.495 and is currently trading around 150.48. The intraday trend of GBPJPY is as long as support 150.69 holds.

USDJPY- Analysis

The pair jumped and hits the highest level since July 2021 level. It should close above 111.65 for major bullishness.

CCI Analysis-

The CCI (50) and Woodies CCI are trading below zero lines in 60 min chart. So the trend for the intraday is bearish.

Technical:

The pair's immediate resistance is around 151.30, any surge above targets 151.80/152/152.60. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 150. Any indicative violation below targets 149/148.40/147.

Indicator (Hourly chart)

Directional movement index –bearish

It is good to sell on rallies around 150.65-70 SL around 151.30 for a TP of 149.