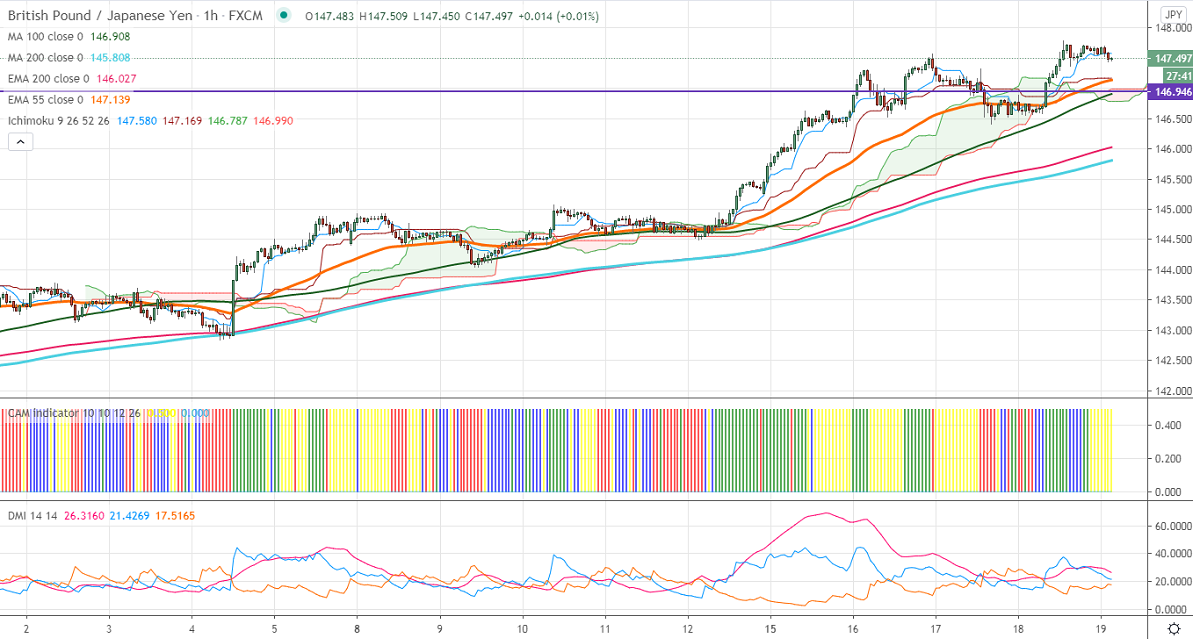

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 146.64

Kijun-Sen- 146.71

GBPJPY took support near 100- H MA and shown a mice recovery on surge in Pound sterling. GBPUSD jumped more than 100 pips on easing UK lockdown restrictions and broad based US dollar weakness. Markets eye UK retail sales data which is to be released today for further direction. USDJPY is trading slightly lower , any violation below 105.50 below confirms further weakness. The intraday trend of GBPJPY is bullish as long as 146.40 hold.

Technical:

The pair's significant resistance at 147.95, any convincing break above confirms bullish continuation. A jump till 150/151.20 possible. On the lower side, near-term support is around 146.40. An indicative break below will drag the pair down till 146/145.80/145/144. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index – neutral

It is good to buy on dips around 1 with SL around 147.50 for the TP of 145.