FxWirePro- Sell GBPJPY on rallies

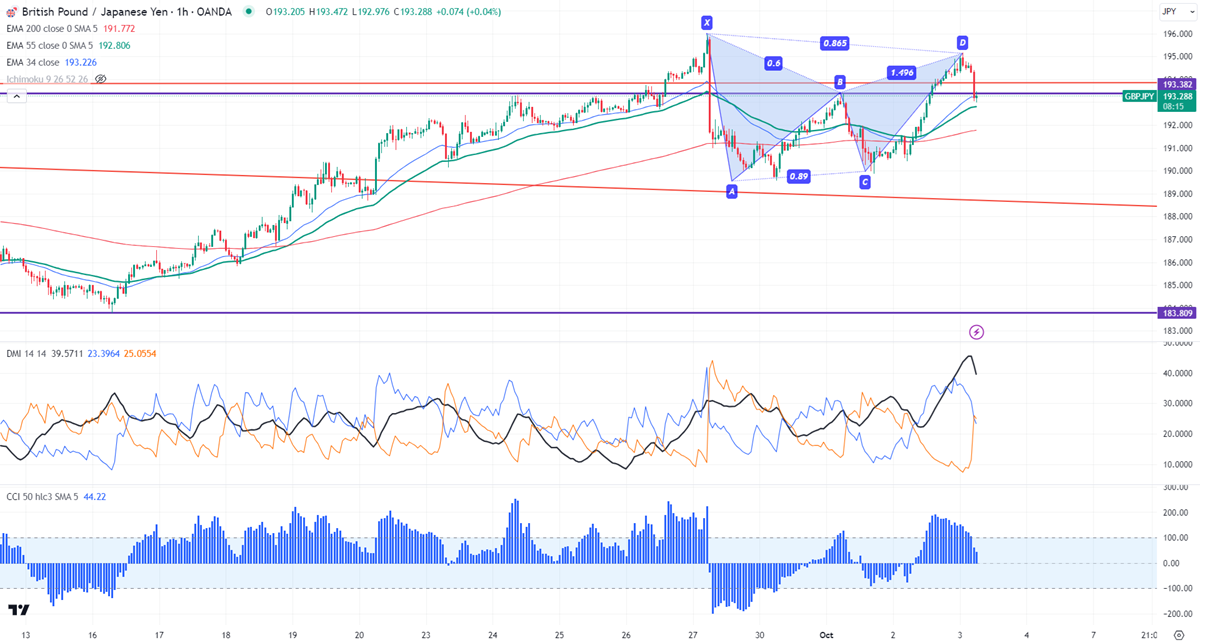

Harmonic pattern- Bearish BAT pattern

GBPJPY pared most of its gained on weak Pound sterling. It hit a high of 195.18 yesterday and is currently trading around 193.315. Overall trend remains bearish as long as resistance 196 holds.

The demand for safe-haven assets like the yen increased after Iran launches 100 missiles toward Israel.

Technicals-

The pair trades below short-term 34, above 55 EMA (193.32 and 192.78), and long-term 200 EMA (191.75) in the one-hour chart.

The near-term resistance is around 193.50, a breach above targets 194.25/195/195.97. Major trend continuation only above 196. The immediate support is at 193, any violation below will drag the pair to 192.50/191.50/190/188/185.85

Indicator (Hourly chart)

CCI (50)- Bullish

ADX- neutral. All indicators confirm a bullish trend.

It is good to sell on rallies around 193.78-80 with SL around 195.20 for a TP of 190.20.