NZDUSD had a good run downwards during the past two weeks and may now be entering a short period of consolidation before resuming the downtrend. The likely range for such a consolidation in 0.7035- 0.7220.

There’s significant local event risk this week from both the Q3 CPI release and the GDT dairy auction (Tue).

The expectations of a 0.2% increase in CPI, for an annual pace of 0.2% is line with the RBNZ’s forecast and probably NZD-market neutral.

The GDT auction is priced by futures to result in a 7% bounce in WMP prices, partly due to a weather-related fall in production. If we do get such a bounce, that would follow two disappointing auctions, and possibly ignite some NZD buying on the day.

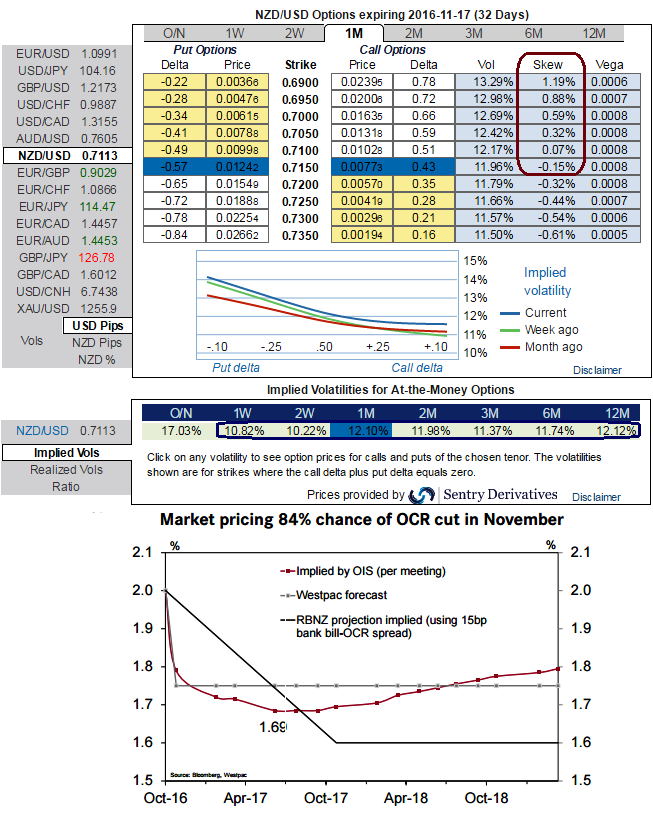

Most importantly, the market pricing for a November OCR cut has rebounded over the past week, from 66% to 84%, in good part due to RBNZ McDermott’s reminder the OCR will be cut further.

The remaining data releases are not market-movers: services PMI (Mon), migration and credit card spending (Fri).

As a result of the above economic indicators that are significant, we could observe intensified OTC FX functions for NZDUSD pair, spiking higher above 12% in 1m tenor.

If IV is high, it means the market ponders the price has the potential for large movement in either direction, subsequently, the forecasts of NZD crosses are also reassessed.

Although the momentum in intermediate term bull trend is slightly reduced, but from the last couple of weeks regained the strength amid growing concerns over global risk sentiments and investors contemplating bullion avenue as safe havens, for September delivery eased 0.06% to $19.862 a troy ounce.

We target 0.70, based on an assumption the Fed will hike in Dec and the RBNZ will cut in November. However the persistent backdrop of global demand for high-yielding currencies is strong - if the Fed doesn’t hike, then 0.75+ is likely instead.

EURNZD is stuck inside a 1.5684-1.5526 sideways range, with significant event risk this week from the ECB. Longer term, security and political risks should weigh on the EUR: the Italian senate reform referendum this month, Italian and Austrian elections in December, and Dutch, French and German elections in 2017. EURNZD should remain below 1.55 levels.

While GBPNZD has further upside potential, and there’s more potential to extend for the all-time lows (in 1973 it was 0.63).

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated