The Mexican peso was among the heaviest losers yesterday. During the course of the day, it eased notably against USD after it became known that a close ally of President Enrique Pena Nieto was arrested on the allegation of illegal election campaign financing.

For the President’s already battered party this is bad news in view of the elections to be held next summer. The chances of the left-wing Morena movement – that is already leading the polls – achieving an election victory have risen further against this background.

A possible swing to the left in Mexican politics is seen critically by investors though as this could put into question fiscal policy stability as well as the reform steps taken so far. Yesterday’s swing in the exchange rates is likely to have provided only a first taste of what may be to come.

We expect increasing volatility the closer the elections get. Short term there is the added uncertainty of the NAFTA negotiations. The Mexican peso is likely to go on a roller coaster ride next year.

Hedge USDMXN via 3-way straddle

The peso has come a long way from its Trump lows and screens overbought and overvalued at current levels, leading our LatAm team to turn underweight recently.

While the pair may head towards any directions with more potential on the downside in near term. According to this price behavior, we advocate below options strategy that is likely to optimize hedging motive.

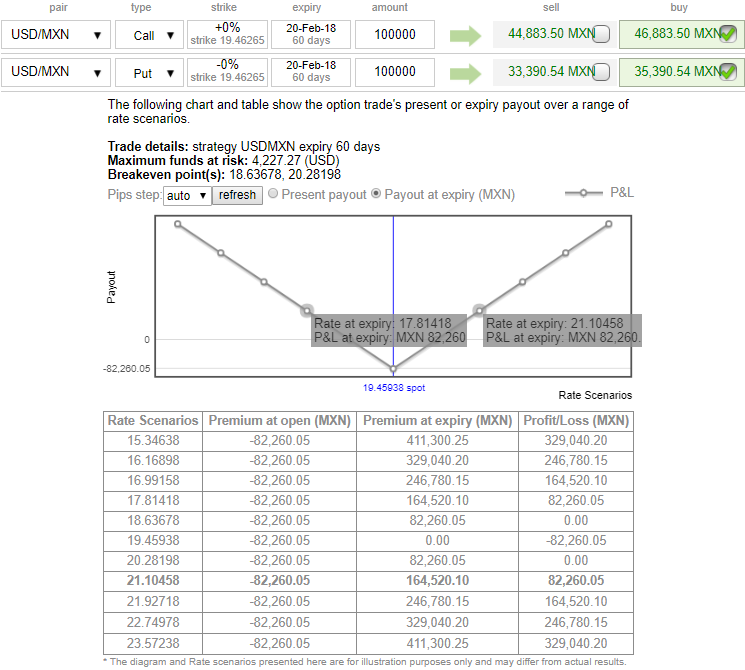

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 19.4575, initiate long in USDMXN 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 1m (1%) out of the money call with positive theta. The short leg with narrowed expiry likely to reduce total hedging cost.

The standout feature of the USDMXN vol surface to us is the cheapness of risk-reversals, both vis-à-vis ATM vols and particularly relative to the amount of carry in forwards that allows for carry efficient expressions of bearish directional views or tail risk hedges.

Risks: Overall EM risk sentiment, higher UST rates or stubborn inflation could lead to the heavy long position being unwound along with debt portfolio outflows. An unfavorable NAFTA outcome is certain to structurally impair the currency.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings