It’s the only G10 currency to have gained against the dollar and it’s the strongest G10 currency over the past fortnight, too.

NZD is only down a bit this week, and that represents a bounce of nearly 1% in two weeks.

Rising US yields have helped the dollar against the yen, and the NOK has lost 2% in a week when oil prices have been trending higher.

Strong PMI data, optimism that a deal can be reached on a Brexit divorce bill and some optimism (somewhat diluted on Friday) that agreement can be reached on an approach to tackling the issue of the UK/Irish border, all conspire to support sterling this week.

Last week, it was manufacturing PMI in the UK that was able to produce upbeat numbers (actual 58.2 against forecasts and previous flash at 56.6) and now the Construction Purchasing Managers’ Index (PMI) picked up from 50.8 in October to 53.1 in November, to remain above the 50.0 no-change value for the second month running. The latest reading was the highest for five months and signaled a solid rate of business activity growth across the construction sector. These upbeat numbers could be interpreted as the positive indication for the British currency.

Shorts have been squeezed and bears have been beaten back.

As a result, please be advised that the 25-delta risk of reversal of GBPUSD has been indicating shoot up as there has been notable shift in hedging sentiment (refer fresh change in risk reversals has been observed across all tenors), know that the shift in risk sentiments for condensed downside risks as we could see positive flashes in negative risk reversals.

The risk reversal curve has been traveling in a positive direction, and it is evident that the shorts in the spot curve are squeezed to converge with the RR curve.

In the 2017 FX Outlook, we articulated a modestly negative set of GBP forecasts but stressed that our conviction level in these was low and that GBP could rise or fall by 5-10% depending on the strategic objectives the government eventually set for Brexit. In other words, the forecast was a probability-weighted average of two extreme binary outcomes.

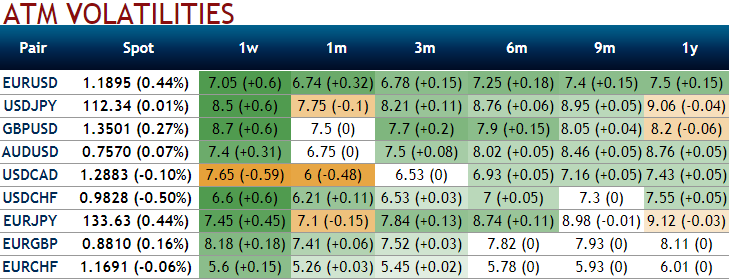

Well, it’s now needless to specify as to why 1m GBP IVs have still been flying no matter what both prior and post Brexit events, but this time these IVs are also owing to UK PMIs, the contracts with longer tenors are normalized too, just a tad below 8% in 1m tenor and shy above 8% in 9m-1y tenors.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields