The Regulators and leading financial firms launched a new code of conduct for global currency trading on Thursday, including measures aimed at forcing its universal adoption by the world's major financial institutions.

Industry players said the code was its last chance to head off full formal regulation of the $5 trillion a day market after a scandal over market manipulation and misuse of client information that saw seven major banks fined around $10 billion at the end of a huge global inquiry in 2015.

Most of the document was published a year ago and the final version's main additions include measures that ask banks and a new generation of electronic traders to provide more details on the algorithms they use and their trading processes, as stated by the sources from the Reuters.

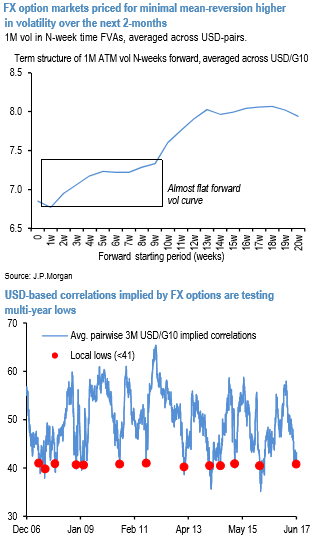

There were some stirrings of life in FX options markets this week, helped by two developments that have potentially taken us one step closer to a pause in the never-ending stretch of vol declines since the beginning of the year.

First, with the passage of the June FOMC, the last major event risk of the month is out of the way, and there is precious little event risk premium left to squeeze out of the front-end vols. On a forward basis, vol curves are almost flat –the average USD/G7 vol curve prices in only a measly 0.4 vols of recovery in 1M ATMs over the next two months from current bargain basement levels in the high-6s (chart 1) – reflecting a market priced for the onset of summer doldrums.

Second, DM monetary policy took a surprisingly hawkish turn this week, with the Fed, BoE, and BoC all catching markets off guard. Coming against the backdrop of solid YTD risk-asset performance and underwhelming macro fund manager returns (HFR Macro/CTA Index +0.6% YTD), it would not be surprising to see risk management considerations spark a round of profit taking on carry /EM positions over the coming 1-2 weeks, and placid option pricing for the very short-expiries may not be consistent with the potential for reasonable realized volatility over this period.

But beyond that brief pocket of opportunity for high frequency gamma hedging which is very much market makers’ rather than investors’ terrain, we gravely doubt whether this alone will be enough to instigate a wholesale risk rout since nominal global growth remains solidly around trend, effects of Chinese credit tightening appear to be fairly controlled, and even petro-currencies are proving relatively resilient to the unexpected weakness in crude prices.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close