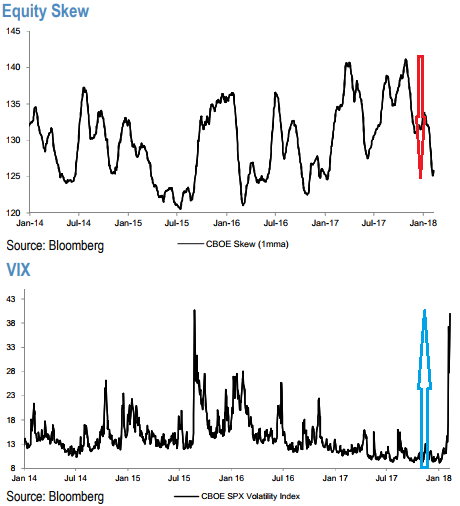

The violent sell-off in equities has lifted FX vols to fair value. Past vol recovery cycles suggest that the correction has further to run before vols plateau at a higher level.

Global equities are now down on the year following strong gains in January, but we advise against positioning for further weakness as

1) Most of the technical indicators that were flashing red earlier this year are now looking oversold and sentiment has turned cautious;

2) The valuations have improved and are not stretched anymore;

3) There is so far limited contagion outside equities with credit and peripheral spreads behaving well;

4) The fundamentals remain supportive with EPS revisions at their best level in 14 years. We see the recent weakness as an opportunity to add and stick to our preference for Eurozone, Value, and Financials.

While USD calls seem to be cheaper in Euro- and Euro-bloc FX, as well as CLP and ZAR in EM.

The recent spike in financial market volatility means financial conditions are less supportive of activity, though they’re still easy. A period of sustained heightened volatility would probably weigh on growth.

Financial markets should expect higher volatility relative to recent years as central banks slowly start to normalize policy. Provided the rise in inflation is gradual, so too should the pick-up in volatility, and this shouldn’t be disruptive to growth.

6M-1Y vega is cheap in EURUSD and USDCHF, especially OTM USD call strikes.

Since the bulk of the dollar selling this year has come against Euro, portfolio hedgers are best advised to buy the clean hedge via EURUSD puts as the first line of defense, especially in 3M-6M maturities where riskies are still bid for EUR calls, not to mention forward points helping carry of Euro shorts.

Currency Strength Index: FxWirePro's hourly EUR spot index is trending higher towards 70 levels (which is bullish) ahead of today’s data announcement of euro area trade balance and US unemployment claims, while hourly USD spot index was at a tad below -145 (highly bearish) at the time of articulating (at 06:48 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics