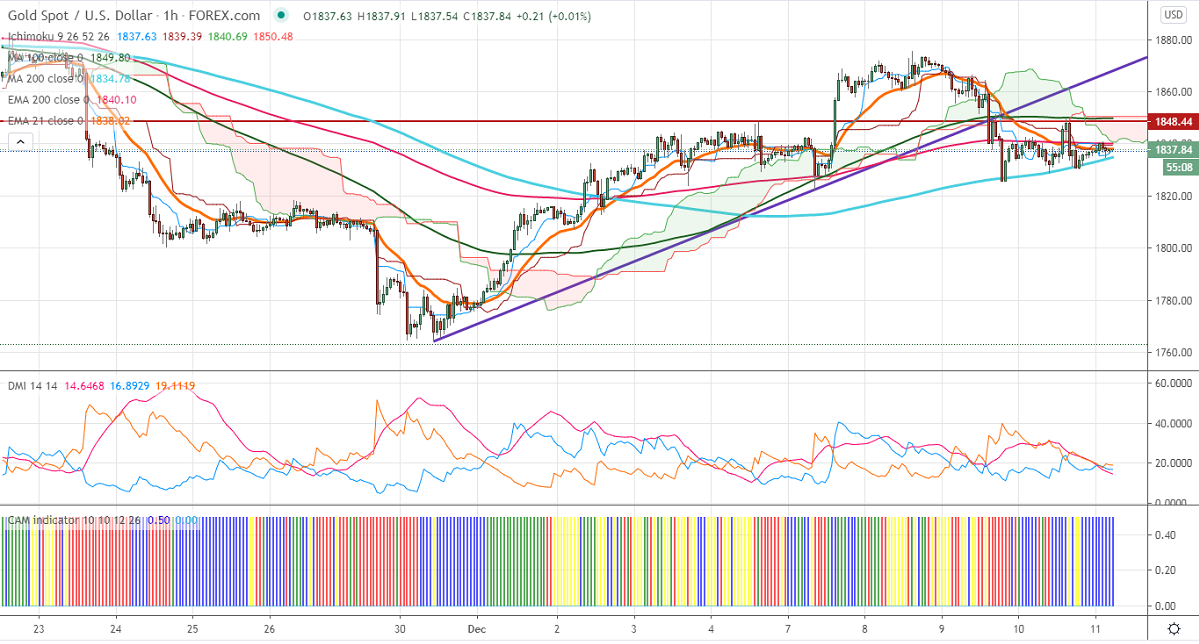

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1835

Kijun-Sen- $1839

Gold is in bearish mode and lost nearly $20 from a high of $1850 despite US dollar weakness. The US FDA has given a green signal to the Pfizer-BioNTech COVID-19 vaccine. Out of 22 voters, 17 voted in favor of the vaccine, four against, and one absentee. US dollar index is trading weak; any break below 90.50 confirms bearish continuation. The US 10-year yield shown a minor dip of more than 3.5% on US stimulus pessimism.

Economic data:

The number of people who have filed for unemployment benefits has increased to 853000 vs an estimate of 725K. US CPI came at 0.2% in November compared to a forecast of 0.1%. The annual inflation unchanged at 1.6%.

Technical:

In the hourly chart, Gold is trading slightly below 100- MA and any violation below $1830 will take the pair till $1822/$1806/$1800. On the higher side, near term resistance is around $1850, any indicative break above targets $1875/$1900/$1912.

It is good to sell on rallies around $1850 with SL around $1861 for the TP of $1825.