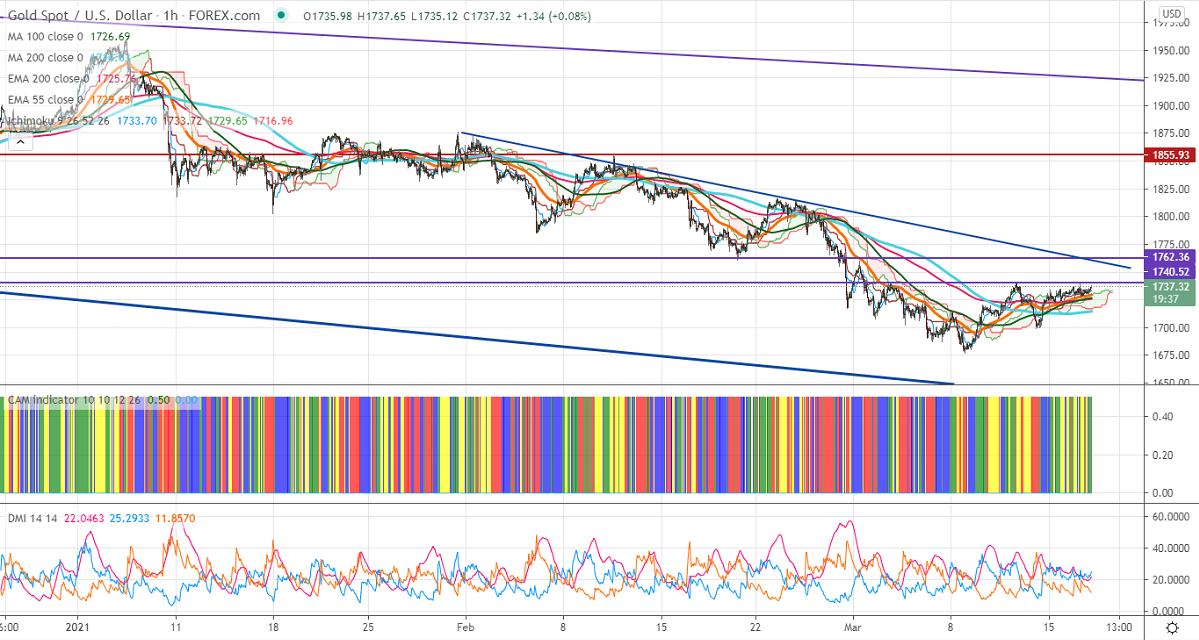

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1732

Kijun-Sen- $1733

Gold is consolidating in a narrow range between $1721.70 and $1741.70 for the past two days ahead of the FOMC meeting. The central bank is expected to keep interest rates and bond-buying programs intact as expected. Markets eye Fed statement and Powell press conference for further direction. US 10-year yield jumped more than 3% from yesterday's low 1.585%.

Economic data:

US retail sales dropped by 3% in Feb compared to a forecast of -0.5. The January data was revised to 7.6% from 5.3% as previously reported.

Technical:

It is facing strong support at $1725, violation below targets $1700/$1685/$1660/$1637. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to buy on dips around $1726-27 with SL around $1714 for the TP of $1760.