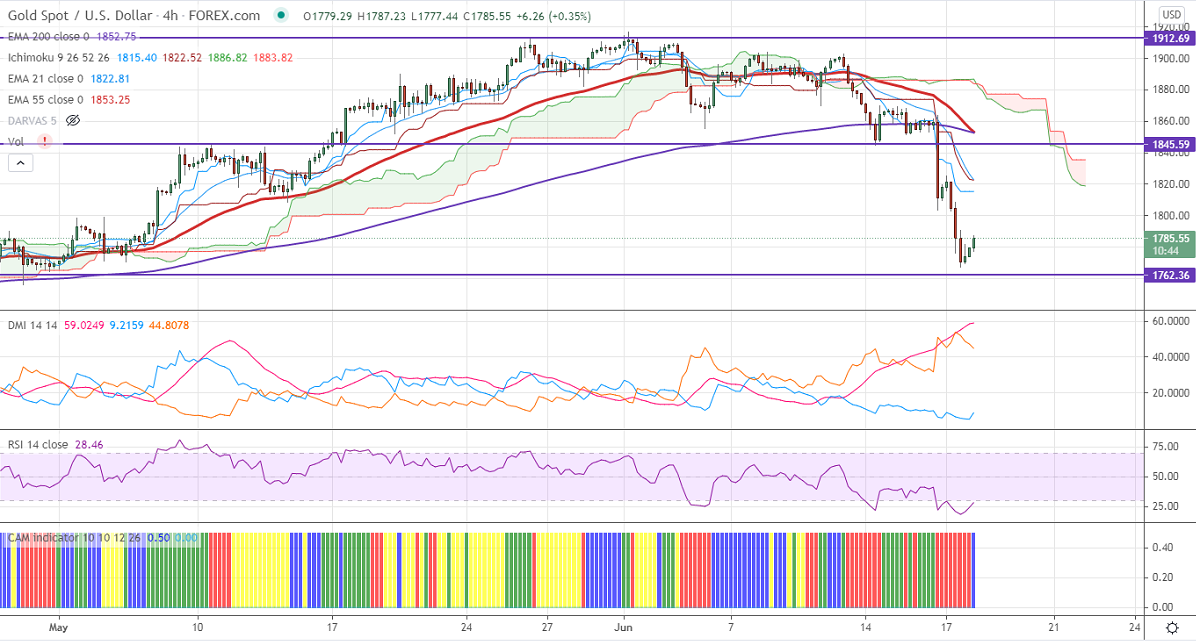

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1815

Kijun-Sen- $1823

Gold continues to trade lower for second consecutive days and lost nearly 100 pips. The Fed has signaled a rise in inflation and dot plot projected to have two rate hikes in 2023. The number of people who have applied for unemployment benefits rose by 37000 to 412000 for the week ended June 12 compared to a forecast of 36000. The US 10-year bond yield pared most of its gains made after the Fed meeting. Gold hits an intraday high of $1787 and is currently trading around $1785.

Technical:

It is facing strong support at $1800, violation below targets $1790/$1754.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1836, any convincing break above will take the yellow metal to $1861/$1875/$1900 is possible.

It is good to sell on rallies around $1802-03 with SL around $1825 for the TP of $1675.