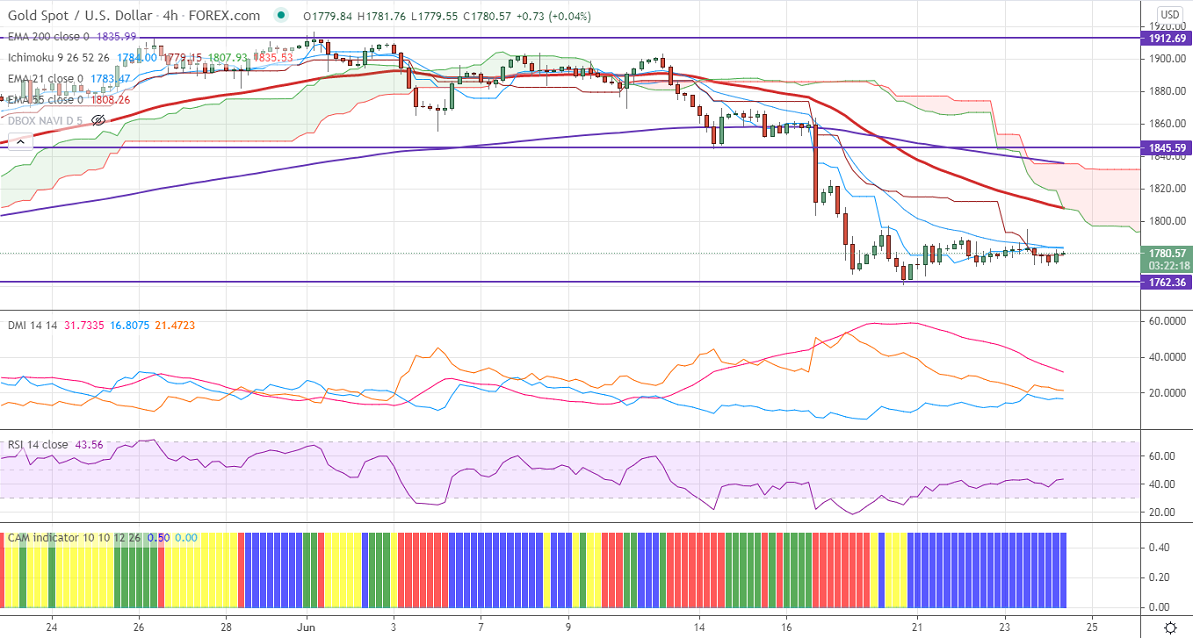

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1784

Kijun-Sen- $1779

Gold is consolidating in a narrow range after a major sell-off. The intraday trend is still bearish as long as resistance $1800 holds. The minor decline in the US dollar index is supporting the yellow metal at lower levels. DXY continues to trade below 92 levels. Any breach below 91.40 confirms bearish continuation. The US 10-year bond yields have formed a minor bottom around 1.354%, shown a minor pullback. Gold hits an intraday high of $1782 and is currently trading around $1781. Markets eye US final GDP, Core Durable goods orders for further direction.

Technical:

It is facing strong support at $1760, violation below targets $1740/$1720/$1700.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal to $1825/$1835/$1860 is possible. It is holding well below 200- day EMA for the past three days.

It is good to sell on rallies around $1800-01 with SL around $1825 for the TP of $1700.