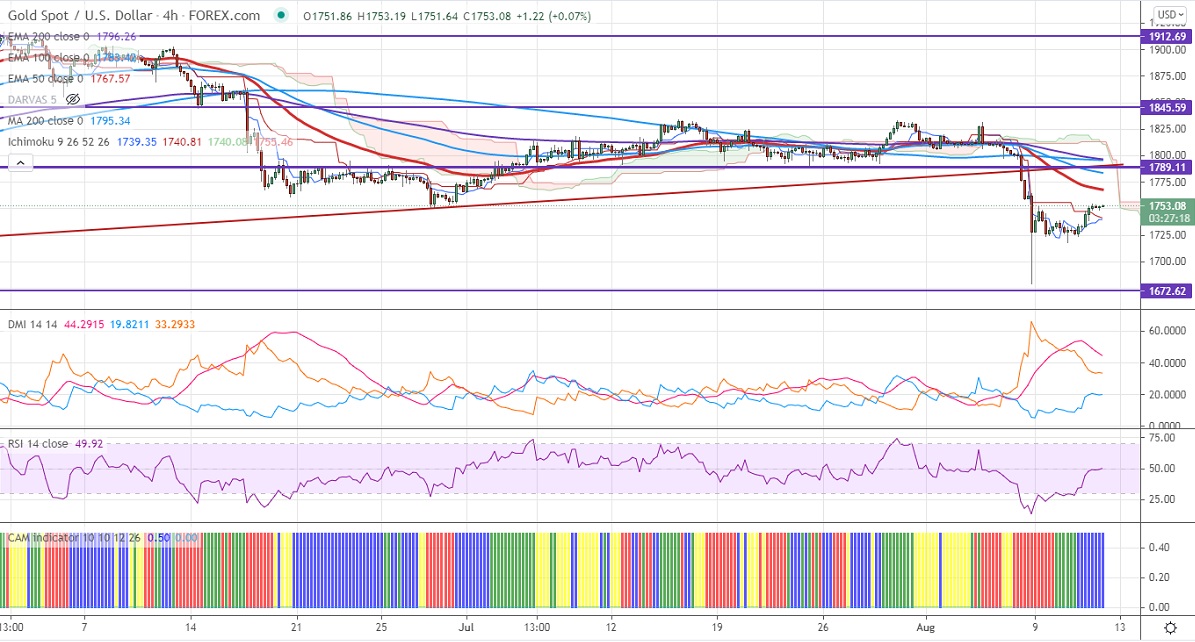

Ichimoku analysis (4- hour chart)

Tenken-Sen- $1739

Kijun-Sen- $1741

Gold surged more than $30 yesterday after US consumer inflation data. The US CPI jump 5.4% in July from a year earlier, but core inflation came at 0.3% below estimate. The US 10-year bond yield lost more than 3% after the auction. The dollar index has formed a double top around 93.20 and shown a sell-off of nearly 40 pips. Markets eye US PPI for further direction and initial jobless claims for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Slightly Bearish (Positive for gold)

US10-year bond yield- Mixed (neutral for gold)

Technical:

It is facing strong support at $1675 violation below confirms that the minor top has formed at $1916. A dip till $1600/$1550 is possible. On the higher side, near-term resistance is around $1750 and a convincing break above will take the yellow metal $1768/$1785/$1800 is possible.

It is good to sell on rallies around $1750 with SL around $1765 for TP of $1675.