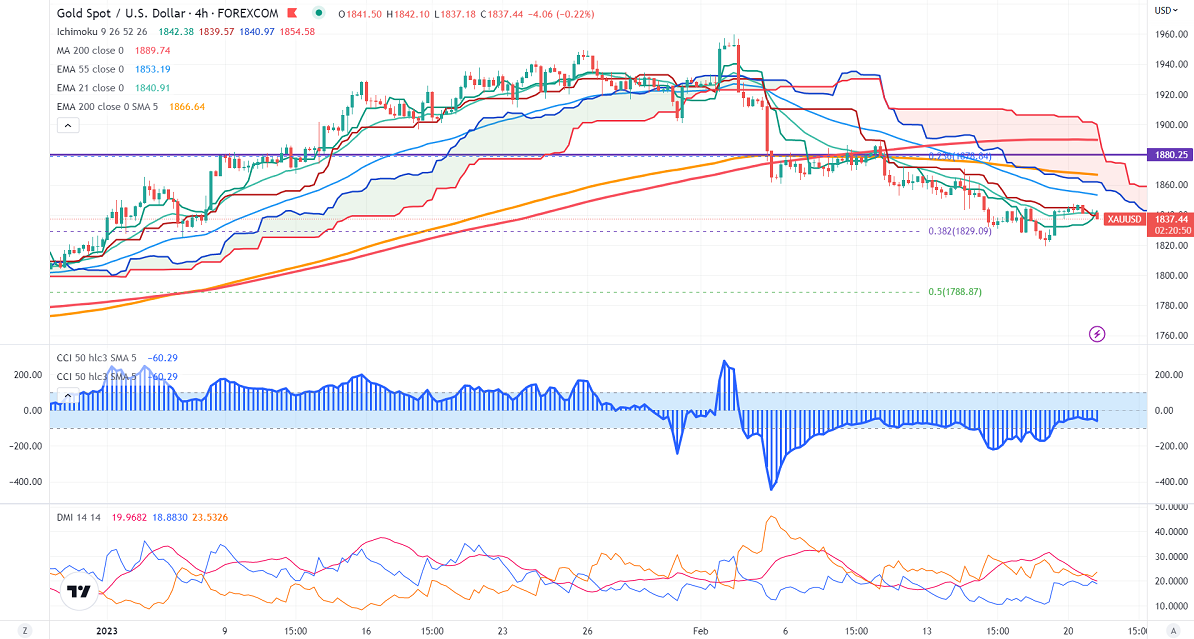

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1837.08

Kijun-Sen- $1839.57

Gold prices trade quietly due to the US market holiday. The yellow metal is cautious as the market eyes a 50 bpbs rate hike in Mar. The upbeat data and inflation has increased the chance of aggressive rate hikes by the Fed. It hits a high of $1847 and is currently trading around $1838.

Major economic data to watch out for

US flash services PMI

US Flash manufacturing PMI

Existing Home Sales

US dollar index-Neutral. Minor support around 102.50/101.50. The near-term resistance is 104.90/106.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar jumped to 18.10% from 9.2% a week ago.

The US 10-year yield trades flat after hitting a multi-week high. The US 10 and 2-year spread narrowed to -80 basis points from -88% bpbs.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Mixed (Neutral for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1816 (21-W EMA), a break below targets of $1800/$1788/$1748. The yellow metal faces minor resistance around $1850, and a breach above will take it to the next level of $1900/$1925/$1950.

It is good to sell on rallies around $1848-51 with SL around $1871 for TP of $1800.