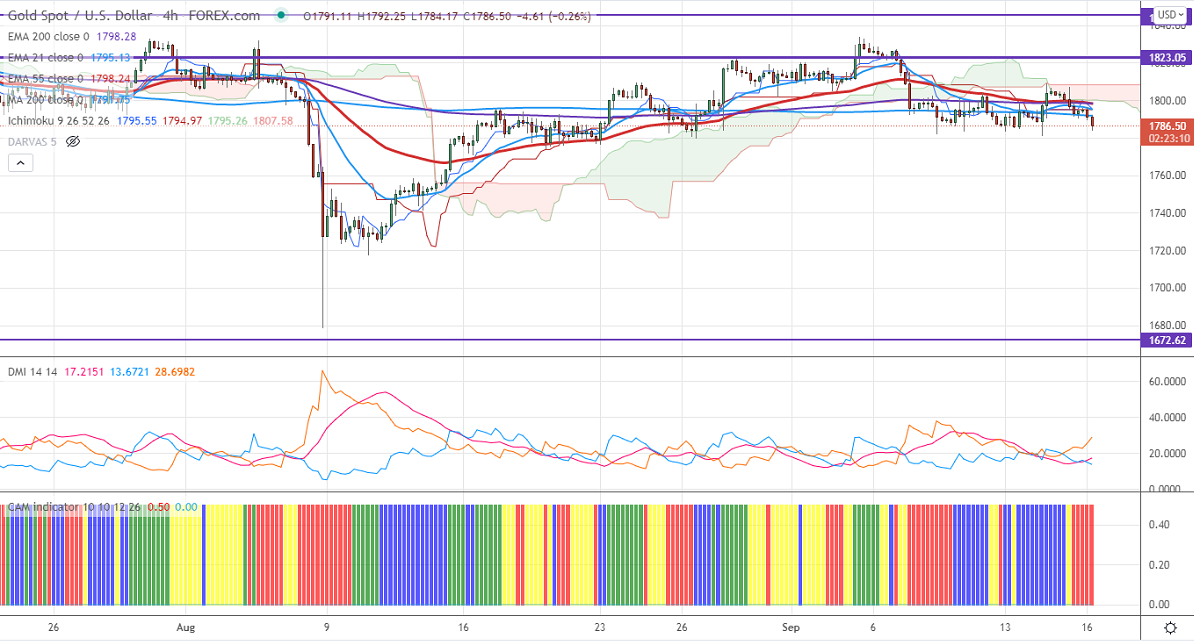

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1798.30

Kijun-Sen- $1794.97

Previous week High- $1830.33

Previous week low- $1782

Gold turned to trade negatively after a nice pullback on Tuesday due to softer US inflation data. The yellow metal is holding below $1800 despite the weak US dollar. Markets eye US retail sales data, Philly fed manufacturing, and initial jobless claims data for further direction. It hits an intraday low of $1784 and is currently trading around $1785.

Economic data-

The headline New York Fed's US empire state manufacturing index rose to 34.3 in September vs. 18 expected.

Factors to watch for gold price action-

Global stock market- Weak (positive for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The immediate resistance is around $1810 and a convincing break above will take the yellow metal $1821/$1835/$1850/$1860/$1877/$1900 is possible. It is facing strong support at $1770, violation below targets $1750/$1725.

It is good to sell on rallies around $1800 with SL around $1820 for TP of $1750.