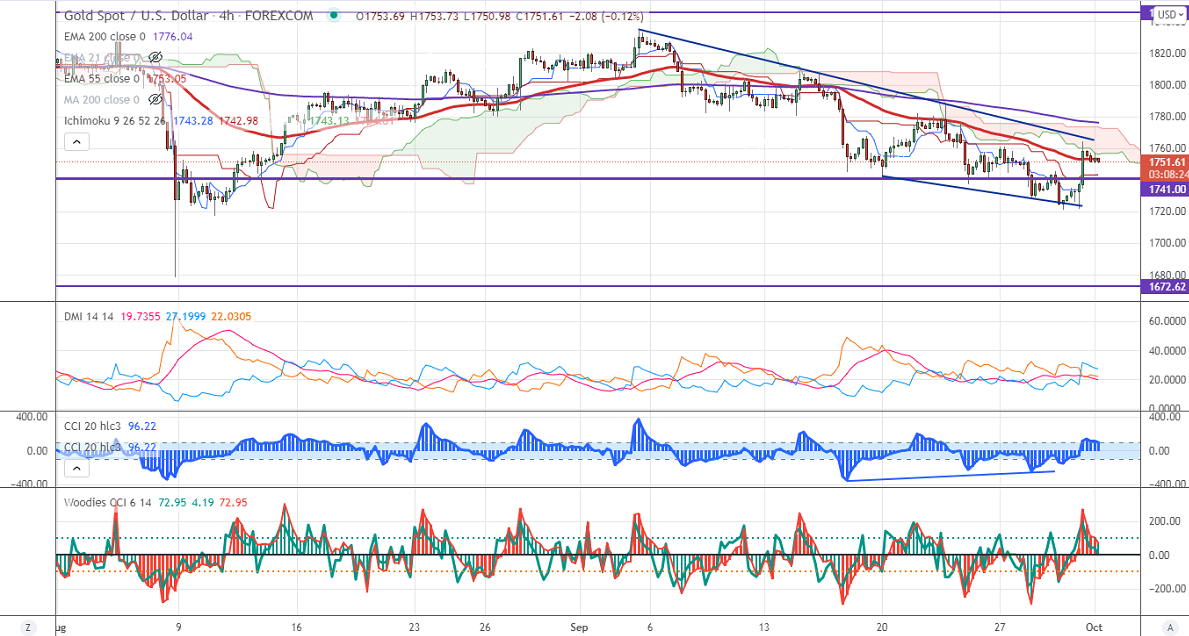

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1742.98

Kijun-Sen- $1742.98

Gold has shown a recovery of more than $40 on declining bond yield. The sell-off in the US stock market also supported the yellow metal at lower levels. The US economy has expanded at a 6.7% annual pace in the second quarter compared to a forecast of 6.6%. The number of people who have filed for unemployment benefits rose by 11000 last week to 362000 vs. an estimate of 333000. The overall trend is still on the downside as long as resistance $1835 holds. Markets eye US ISM manufacturing for further direction. The factors dragging the gold prices are

USDJPY-

The yen and gold are 90% positively correlated to each other. USDJPY declined due to profit booking after hitting a fresh multi-year high at 112.05. Any breach below 110.80 confirms intraday bearishness.

US Dollar index-

DXY is holding above 200-W EMA. Any weekly close above 94.15 confirms further bullishness.

US 10-year yield- It has slightly cooled off after hitting a high of 1.56%.

Technical:

The immediate resistance is around $1765 and a convincing break above will take the yellow metal $1775/$1780/$1787 if possible. It is facing strong support at $1720, violation below targets $1700/$1675.

It is good to sell on rallies around $1772-73 with SL around $1787 for TP of $1675.