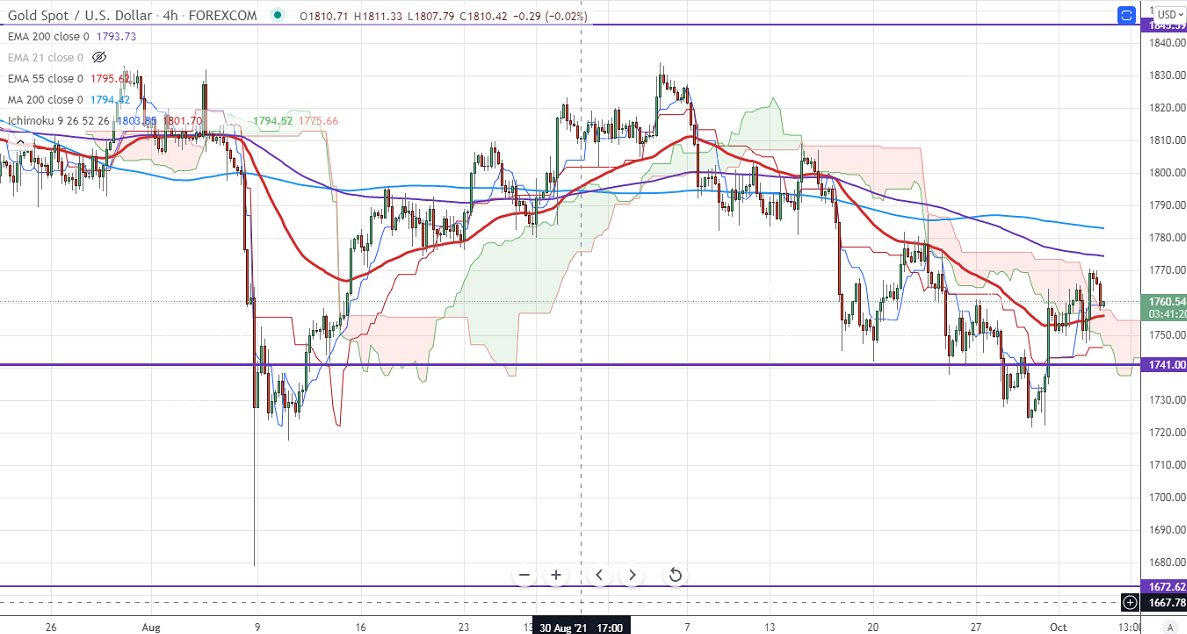

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1759

Kijun-Sen- $1746

Gold has halted its two days of the bullish trend and lost more than $10 on a strong US dollar. The US dollar index recovered slightly after hitting a low of 93.67. It should close above 94.50 for further direction. The surge in crude oil price and China's Evergrande debt crisis are supporting the yellow metal at a lower price. The overall trend is still on the downside as long as resistance $1835 holds. Markets eye US ISM services data for further direction. The factors dragging the gold prices are

USDJPY-

The yen and gold are 90% positively correlated to each other. USDJPY jumped after a minor decline below 111 level on rising US treasury yield.

US 10-year yield- It has regained more than 3.5% from a low of 1.455%.

Technical:

The immediate resistance is around $1770 and a convincing break above will take the yellow metal to $1787/$1800. It is facing strong support at $1750, violation below targets $1740/$1720.

It is good to sell on rallies around $1770-71 with SL around $1787 for TP of $1675.