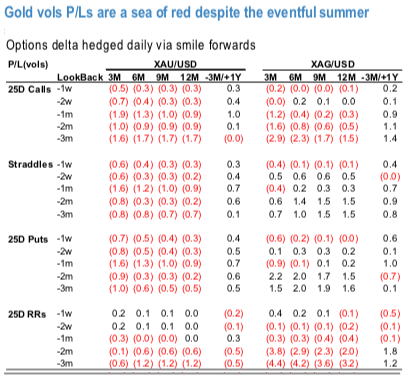

Despite an eventful summer and an almost 6% slide in gold price over the past three months, gold vols under-delivered across strikes and tenors (refer 1st chart). Historically, such price moves were worth 2-3 vol pts in 3M ATM vol. That makes last quarter’s gold underperformance especially notable. With vega leading the way, silver vols performed more in line with historicals (13% spot selloff vs. 0.7- 1.0vol of P/L from delta-hedged straddles). Bailed out by the underperformance of short tenor vols, vega-neutral, - 3M/+12M short gold gamma calendar spreads delivered modestly positive P/Ls over various lookback windows.

A closer look at the performance of gold gamma and risk reversals around tariff announcements is shown in 2nd chart. Except for the notable move post-March 22nd (+1.1vols and +1.5vols for vols and riskies respectively), on average vols and risk reversals were mostly muted in the aftermath of the announcements.

This however masks the higher frequency dynamic of short lived vol spikes (as large as 1.3-2.2vols). Obviously, timing was everything in 3Q as buy and hold got decimated by swift vol reversals (as clearly evident from 1st chart). Gold vols decoupled from alternative eserve currency FX peers (JPY, EUR and CHF) with 6M XAU-safe haven FX correlations back to near YTD lows even though JPY, EUR and CHF vols have broadly fared similarly poorly.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 12 levels (which is bullish), while hourly USD spot index was at 35 (mildly bullish) while articulating (at 11:12 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis